developersjp.online

Community

Track My Stock Portfolio App

Leading online stock portfolio tracker & reporting tool for investors. Sharesight tracks stock prices, trades, dividends, performance and tax! portfolio management, financial planning, and investment tracking. find most comfortable and effective for managing your portfolio. Quickly track the performance of your stock portfolios in the stock market - Track stocks and equity, funds, ETFs, currencies in the stock market, and unlisted. Stock & Crypto Portfolio Tracker. DeFi, NFTs, Funds, Bonds, Homes, Cars, Metals and more. International bank & brokerage accounts. Supports all currencies. Quickly track the performance of your stock portfolios in the stock market - Track stocks and equity, funds, ETFs, currencies in the stock market, and unlisted. Trusted by investors over + countries, Portseido is your best portfolio tracking & reporting solution that helps you track all investments in one place. In my (well-researched) opinion, Morningstar Premium is the best stock portfolio tracker software for professional analysis in Empower is considered one of the best free portfolio tracking apps. It offers advanced free tools to help you track investments and plan your retirement. FINARKY. It's a minimalist mobile app that calculates my Personal Rate of Return (the most useful metric to track the performance of a portfolio. Leading online stock portfolio tracker & reporting tool for investors. Sharesight tracks stock prices, trades, dividends, performance and tax! portfolio management, financial planning, and investment tracking. find most comfortable and effective for managing your portfolio. Quickly track the performance of your stock portfolios in the stock market - Track stocks and equity, funds, ETFs, currencies in the stock market, and unlisted. Stock & Crypto Portfolio Tracker. DeFi, NFTs, Funds, Bonds, Homes, Cars, Metals and more. International bank & brokerage accounts. Supports all currencies. Quickly track the performance of your stock portfolios in the stock market - Track stocks and equity, funds, ETFs, currencies in the stock market, and unlisted. Trusted by investors over + countries, Portseido is your best portfolio tracking & reporting solution that helps you track all investments in one place. In my (well-researched) opinion, Morningstar Premium is the best stock portfolio tracker software for professional analysis in Empower is considered one of the best free portfolio tracking apps. It offers advanced free tools to help you track investments and plan your retirement. FINARKY. It's a minimalist mobile app that calculates my Personal Rate of Return (the most useful metric to track the performance of a portfolio.

Track your portfolio's performance. Get a better view of your stocks, ETFs, and cryptocurrencies with an easy-to-use portfolio tracker. See all your investments in one place and get an aggregated view of your holdings. Track stocks, ETFs, funds and add any alternative assets. Navexa is a powerful portfolio tracking & reporting tool that allows investors to track stocks, crypto, currency and more in a single analytics account. Read. Manage your stock portfolios and view performance over time, with metrics such as realized gains, unrealized gains, daily and total changes, and annualized. Portfolio Trader is a sophisticated stock portfolio tracking app for iPhone, iPad and Apple Watch, providing in depth analyis of your share holdings and other. The 4 Top Portfolio Management Apps · 1. Empower (Formerly Personal Capital) · 2. SigFig Wealth Management · 3. Sharesight · 4. Yahoo! Finance. Advanced portfolio tracking, investment analytics & reporting tools. Track performance, dividend income, currency gains & more. Get started now! The #1 investment tracking app that helps you keep track of your crypto, stocks, ETFs, commodities, NFTs, and forex in one place. Quickly monitor stocks and track the performance of your stock portfolios. ✓ Multi-portfolio support ✓ Convert portfolios to one currency using real-time. Portfolio from Globe Investor allows you to make faster, informed decisions to manage and track your investments. Performance and income tracking plus. Track your personal stock portfolios and watch lists, and automatically determine your day gain and total gain at Yahoo Finance. The best portfolio trackers make it easy to visualize all your investments in one place and track performance and asset allocation across multiple accounts. With the help of a stock monitoring app, you can get an idea of what's happening with the markets, individual stocks, and even your portfolio. Our Stock Portfolio Tracker makes it easy to track the performance and analyze all of your investments in one place. The Best Investment Tracking Apps · 2. Quicken Premier. Quicken Premier is another piece of high-octane budgeting software that lets you track your investments. Get Delta. Your ultimate portfolio tracker for stocks, crypto, funds, ETFs, indices and much more. Deep portfolio insights and alerts so you don't miss out. Track your Net Worth automatically on your phone. Get a clear overview of your best-performing investments and make investments decisions based on data. Track your favorite stocks and portfolio holdings. Get FREE real-time news & analysis to your email. Join Seeking Alpha, the world's largest investing. Ziggma's free portfolio tracker provides long term investors with a powerful toolkit to build wealth and reach their investment goals. The 10 best portfolio tracker apps offer potent tools that are reliable and secure for successful stock portfolio management.

Best Way To Pay Debt Collection Agency

Tell them you'd like to negotiate paying off your debt. Tell them you're in a better position now but not $ better. Offer $ and go from. Scammers don't want to be found, so they often insist you make a payment by Visa gift card, iTunes gift card, wire transfer—or some other untraceable method. But consider talking to the collector at least once, especially if you don't think you owe the debt or can't repay it immediately. That way, you might be able. Use a debt collection agency to try to make you pay Take two minutes to answer a few simple questions, so we can understand the best way to help you. When a collection agency contacts people you know, they are not allowed to say why they are trying to contact you or how much you owe. To stop a debt collector. The best way to avoid garnishment is by paying your bills on time. Do not ignore letters from collection agencies, even if you dispute a debt. If you are. You can either call the collections agency and pay it off through them or you can sometimes call the origional place the bill is from and offer them a lesser. Make sure you respond in writing to dispute the debt. If you don't, the debt collector may keep trying to collect the debt from you and may even end up suing. It's more secure than giving collectors your information by ACH transfer or personal check. You'll also want to steer clear of options like paying with a credit. Tell them you'd like to negotiate paying off your debt. Tell them you're in a better position now but not $ better. Offer $ and go from. Scammers don't want to be found, so they often insist you make a payment by Visa gift card, iTunes gift card, wire transfer—or some other untraceable method. But consider talking to the collector at least once, especially if you don't think you owe the debt or can't repay it immediately. That way, you might be able. Use a debt collection agency to try to make you pay Take two minutes to answer a few simple questions, so we can understand the best way to help you. When a collection agency contacts people you know, they are not allowed to say why they are trying to contact you or how much you owe. To stop a debt collector. The best way to avoid garnishment is by paying your bills on time. Do not ignore letters from collection agencies, even if you dispute a debt. If you are. You can either call the collections agency and pay it off through them or you can sometimes call the origional place the bill is from and offer them a lesser. Make sure you respond in writing to dispute the debt. If you don't, the debt collector may keep trying to collect the debt from you and may even end up suing. It's more secure than giving collectors your information by ACH transfer or personal check. You'll also want to steer clear of options like paying with a credit.

You need to attempt what's called pay for delete for any accounts that are in collections. You want the collection agency to delete the. They can also conduct searches for a debtor's assets, such as bank and brokerage accounts, to determine their ability to repay. A debt collector has to rely on. Debt settlement involves offering a lump-sum payment to a creditor in exchange for a portion of your debt being forgiven. · You can attempt to settle debts on. Don't miss your court date! · If you can't afford to pay a debt let the court know. · If you agree to a payment plan with the debt collector, ask for a copy of. Cash, credit card, cheque, bank draft, money order, etc. My advice is to use a method of payment that can be easily proven. The reason for this. We work with debtors based on their ability to pay. We send letters, receive and place telephone calls, refer debts to the Treasury Offset Program, garnish. The agency may not contact you after that unless you are sent proof of the debt, such as a copy of the bill. A debt collector may not harass or abuse anyone. If you owe a debt, act quickly — preferably before it's sent to a collection agency. Contact your creditor, explain your situation and try to create a payment. Work directly with the collection agency to pay the debt. Sometimes the collection agency will let you make payments or will accept a lower amount. Call our. Offering your customers a small percentage off the total invoice amount for early payment may entice them to pay the invoice before the due date. It's good for. "The best thing to do to avoid having your debt going to collections is contact the creditor to set up a payment plan or ask for reduction on the amount of debt. There are several situations where this may be a good option for the debt collector if they can get some of the money back and not have to pay court costs. What is the best way to manage and pay off debt? The best solution depends What to Know When Your Creditor Sells Your Debt to a Collection Agency. Remember, it is to the creditor's advantage to avoid bringing in a debt collection agency. However, if it begins to look as if you will not be able to pay the. Generally, paying the original creditor rather than a debt collector is better. The creditor has more discretion and flexibility in negotiating payment terms. You do not have to give cash to a collection agent who visits you at home. Call the company to set up a standing order if you can afford payments. If you do. What is the best way to negotiate a settlement with a debt collector ▫ Be honest with yourself about how much you can pay each month. Review your. Scammers don't want to be found, so they often insist you make a payment by Visa gift card, iTunes gift card, wire transfer—or some other untraceable method. Once you've come to an agreement with a debt collector, ask for the settlement amount or payment plan in writing and make copies of any paperwork they send you. Only when you have determined your preferred strategy — lump sum, payment plan, or some combination — should you contact the debt collection agency. While it's.

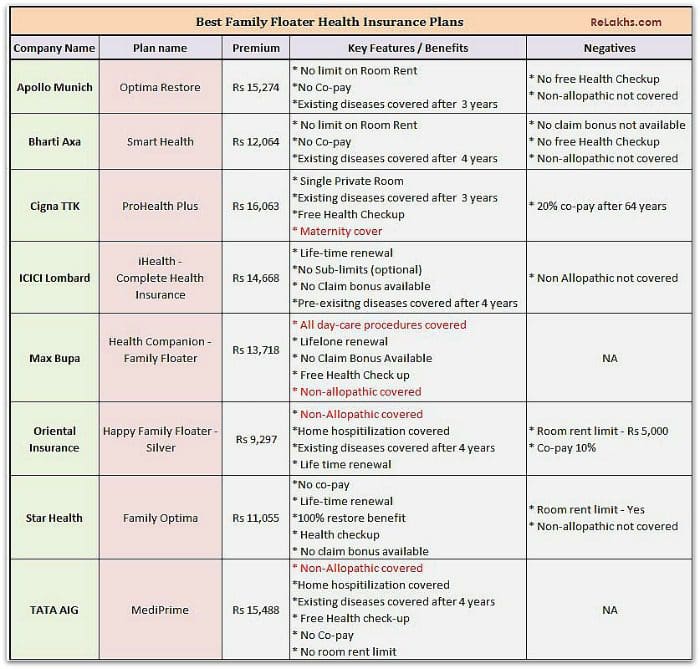

Compare Health Insurance Plans India

Choosing the best health insurance in India that aligns with your needs not only grants you coverage when required but also opens the door to regular medical. We will make it easier for you by highlight 7 things you should keep in mind when evaluating the various medical insurance plans in India. Step 1: Visit the health insurer's website. For example, developersjp.online ; Step 2: Click on 'Buy Insurance' or another equivalent button to begin the process. Comparing health insurance plans gives you a clear vision of the possible premiums, deductibles and other such expenditures. Purchasing the best health insurance policy in India is essential to safeguard your well-being and finances. It offers comprehensive coverage for medical. These are the best health insurance plans that help you get more coverage if your basic sum insured is exhausted during a medical emergency. Top-up or super top. Find the best health plan in India for you and your family. Compare and review top plans on metrics like insurer rating, features, and affordability. All Insurers ; ICICI Lombard Elevate logo. ICICI Lombard Elevate ; HDFC Ergo Optima Secure logo. HDFC Ergo Optima Secure ; ICICI Lombard Health AdvantEdge logo. Best Health Insurance: Compare online all medical insurance policies & buy the best one for family, individuals & senior citizen from top insurers in India. Choosing the best health insurance in India that aligns with your needs not only grants you coverage when required but also opens the door to regular medical. We will make it easier for you by highlight 7 things you should keep in mind when evaluating the various medical insurance plans in India. Step 1: Visit the health insurer's website. For example, developersjp.online ; Step 2: Click on 'Buy Insurance' or another equivalent button to begin the process. Comparing health insurance plans gives you a clear vision of the possible premiums, deductibles and other such expenditures. Purchasing the best health insurance policy in India is essential to safeguard your well-being and finances. It offers comprehensive coverage for medical. These are the best health insurance plans that help you get more coverage if your basic sum insured is exhausted during a medical emergency. Top-up or super top. Find the best health plan in India for you and your family. Compare and review top plans on metrics like insurer rating, features, and affordability. All Insurers ; ICICI Lombard Elevate logo. ICICI Lombard Elevate ; HDFC Ergo Optima Secure logo. HDFC Ergo Optima Secure ; ICICI Lombard Health AdvantEdge logo. Best Health Insurance: Compare online all medical insurance policies & buy the best one for family, individuals & senior citizen from top insurers in India.

Health Insurance plans to secure you and your family. Get a 5% discount on premium for the first online purchase of selected medical policies. Health insurance plans reimburse insured customers for their medical expenses, including treatments, surgeries, hospitalisation and the like. You can use an online health insurance premium calculator to compare the premiums of different policies. This can provide you with an accurate estimate of your. With a suitable Tata AIG health insurance plan, you can avail of cashless hospitalisation benefits in any of Tata AIG's 7,+ network hospitals across India. Health Insurance. Upto 25% Off*. Compare & Buy Customised Health Plans starting at just Rs/month* Health insurance policies in India also provide coverage. This is India's top-ranking health insurance plan which gives amazing benefits. For example, coverage from day 01, zero deductions on claims, and the option to. How to Compare Health Insurance? · Visit the official website of RenewBuy (developersjp.online). · Go to the RenewBuy “Health Insurance Premium Calculator” page. Yeah. It is costly but the sole purpose of Health Insurance is to provide claim easily when needed. I felt this policy will have the most. Know how to compare health insurance plans in India so that you can choose the best option. Comparing health plans can help you know the benefits of. How to Compare Mediclaim Policy? · Step 2: Enter your mobile number and click on the 'View Plan' button or similar options on other insurer's websites. · Step 3. Simplified Plan Comparison: Online platforms such as developersjp.online make it effortless to compare health insurance plans from various insurers, aiding you in. Health insurance plans in India are basic indemnity-based insurance products, which are specifically designed to provide financial assistance against medical. Star Health Insurance Co. Family Health Optima Insurance Plan, 3 Lakh/25 Lakh, Covered after 4 years, Applicable, 60/90 days, Max up to 35%. Day Care & OPD Charges: Until recently, a minimum hospitalization of 24 hours was required to cover health insurance policies in India. However, due to recent. Compare Multiple Plans Instantly. Quickinsure website instantly allows you to compare multiple insurance plans based on your requirements. I recommend everyone. You can compare health insurance plans from a variety of providers. This allows you to choose the method best suits your needs and budget. You can easily compare health insurance plans from various insurers and then decide on the plan. Some of the good health insurance plans and their premiums are. How to compare the best Health Insurance in India? Cheap and best Health Insurance in India, Get quote and compare Indian mediclaim insurance policies offered by Indian insurers.

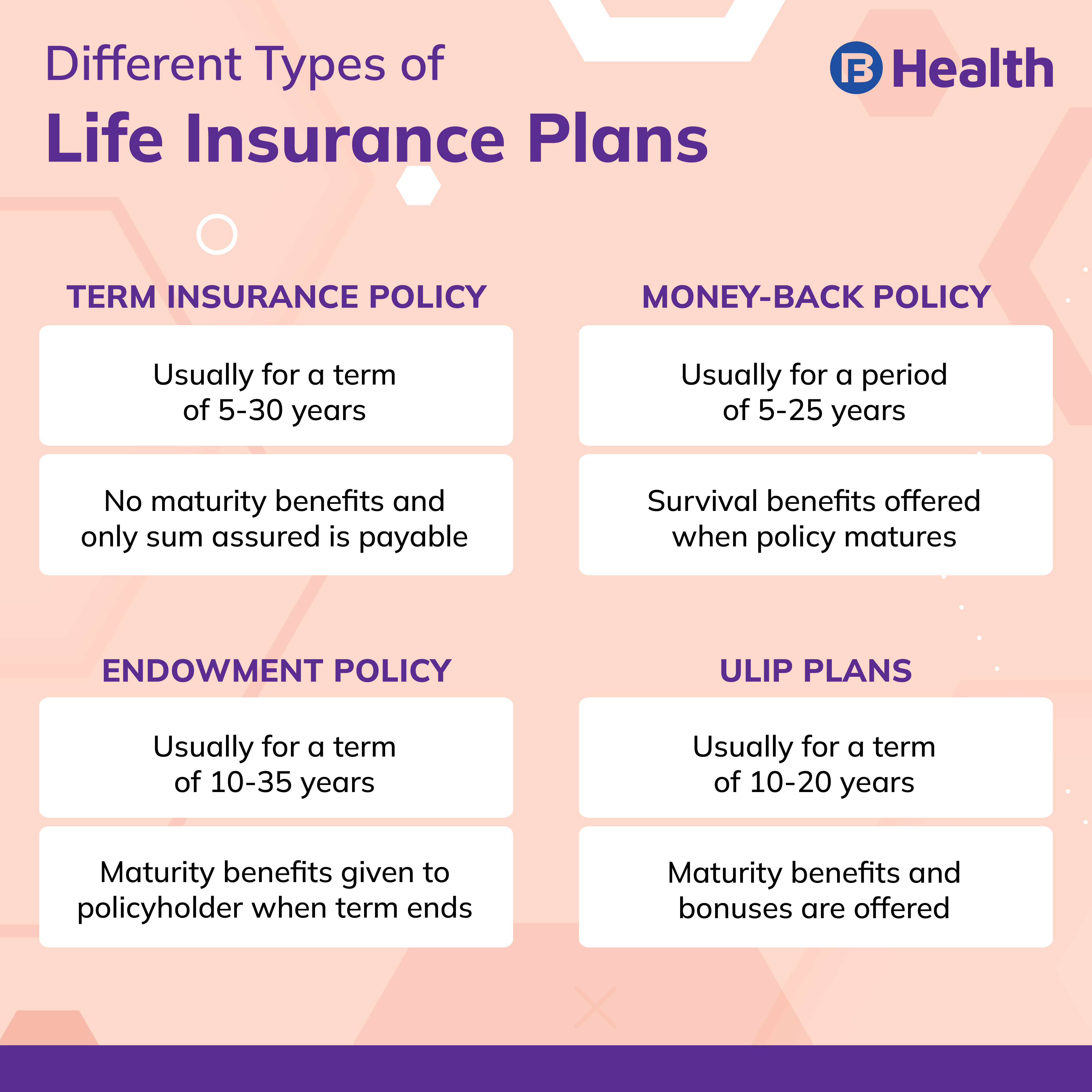

What Does Life Insurance Provide

Life insurance is a contract between a policyholder and an insurance company that pays out a death benefit when the insured person passes away. · There are. It's designed to help ease financial burdens on your loved ones and help them cover everything from groceries to the mortgage. It's called Term life. Life insurance is a form of insurance that pays a beneficiary in the event of the death of the insured person. Primerica's life insurance companies offer affordable term life insurance protection ranging from a year level premium policy all the way up to a year. Guaranteed acceptance whole life insurance. Designed to give you lifetime coverage regardless of health. What is the best life insurance for me? Each type of. The primary purpose of life insurance is to provide a financial benefit to dependents upon premature death of an insured person. It provides lifetime coverage. · It allows you to pay premiums at a fixed rate for as long as the policy is in force. · It accumulates cash value over time. · It. Life insurance is divided into two basic categories — “term” and “permanent”. Term life insurance provides coverage for a specific period of time. Life insurance provides money to your family after you die to help them pay for burial costs, living expenses, bills, and education. Life insurance is a contract between a policyholder and an insurance company that pays out a death benefit when the insured person passes away. · There are. It's designed to help ease financial burdens on your loved ones and help them cover everything from groceries to the mortgage. It's called Term life. Life insurance is a form of insurance that pays a beneficiary in the event of the death of the insured person. Primerica's life insurance companies offer affordable term life insurance protection ranging from a year level premium policy all the way up to a year. Guaranteed acceptance whole life insurance. Designed to give you lifetime coverage regardless of health. What is the best life insurance for me? Each type of. The primary purpose of life insurance is to provide a financial benefit to dependents upon premature death of an insured person. It provides lifetime coverage. · It allows you to pay premiums at a fixed rate for as long as the policy is in force. · It accumulates cash value over time. · It. Life insurance is divided into two basic categories — “term” and “permanent”. Term life insurance provides coverage for a specific period of time. Life insurance provides money to your family after you die to help them pay for burial costs, living expenses, bills, and education.

A term life insurance policy is the simplest, purest form of life insurance: You pay a premium for a period of time – typically between 10 and 30 years. Life insurance is meant to provide coverage should you pass away whether it be due to natural causes, accident or illness. There are, however, circumstances. What you may be missing is that a form of life insurance, called cash value life insurance, can be part of a diversified financial portfolio. It provides. Agent - An insurance company representative licensed by the state who solicits and negotiates contracts of insurance, and provides service to the policyholder. It provides financial security, helps to pay off debts, helps to pay living expenses, and helps to pay any medical or final expenses. Some common uses for these funds include paying for funeral services, child tuition, mortgage payments, and other everyday expenses that would be a considerable. A term life insurance policy is the simplest, purest form of life insurance: You pay premiums for a set year, year, or sometimes year time frame. Whole life insurance provides insurance for your entire life as long as you pay all your premiums. It includes a death benefit and cash value, which accrues. Whole life insurance provides insurance for your entire life as long as you pay all your premiums. It includes a death benefit and cash value, which accrues. Joint Life and Survivor Insurance provides coverage for two or more persons with the death benefit payable at the death of the last of the insureds. Do you need Life Insurance? If you provide financial support, or provide such services as child care, cooking, and cleaning for your family, life insurance. The goal of life insurance is to provide a measure of financial security for your family after you die. A life insurance policy will help them meet the. Life insurance is designed to reassure you that your dependants, such as your children or a partner, will be financially looked after in the event of your. The purpose of life insurance is to provide financial protection to your loved ones after your death. Term life insurance provides a death benefit for a set period, typically between 10 and 20 years. This is straightforward insurance, and it's what most people. MassMutual offers a wide range of life insurance types. Our life insurance policies and products can provide coverage for you and your loved ones. Life insurance is purchased to pay off debts and/or provide financial security to loved ones after death. It's often used to cover funeral costs, replace income. Life insurance provides money to your family after you die to help them pay for burial costs, living expenses, bills, and education. MassMutual offers a wide range of life insurance types. Our life insurance policies and products can provide coverage for you and your loved ones.

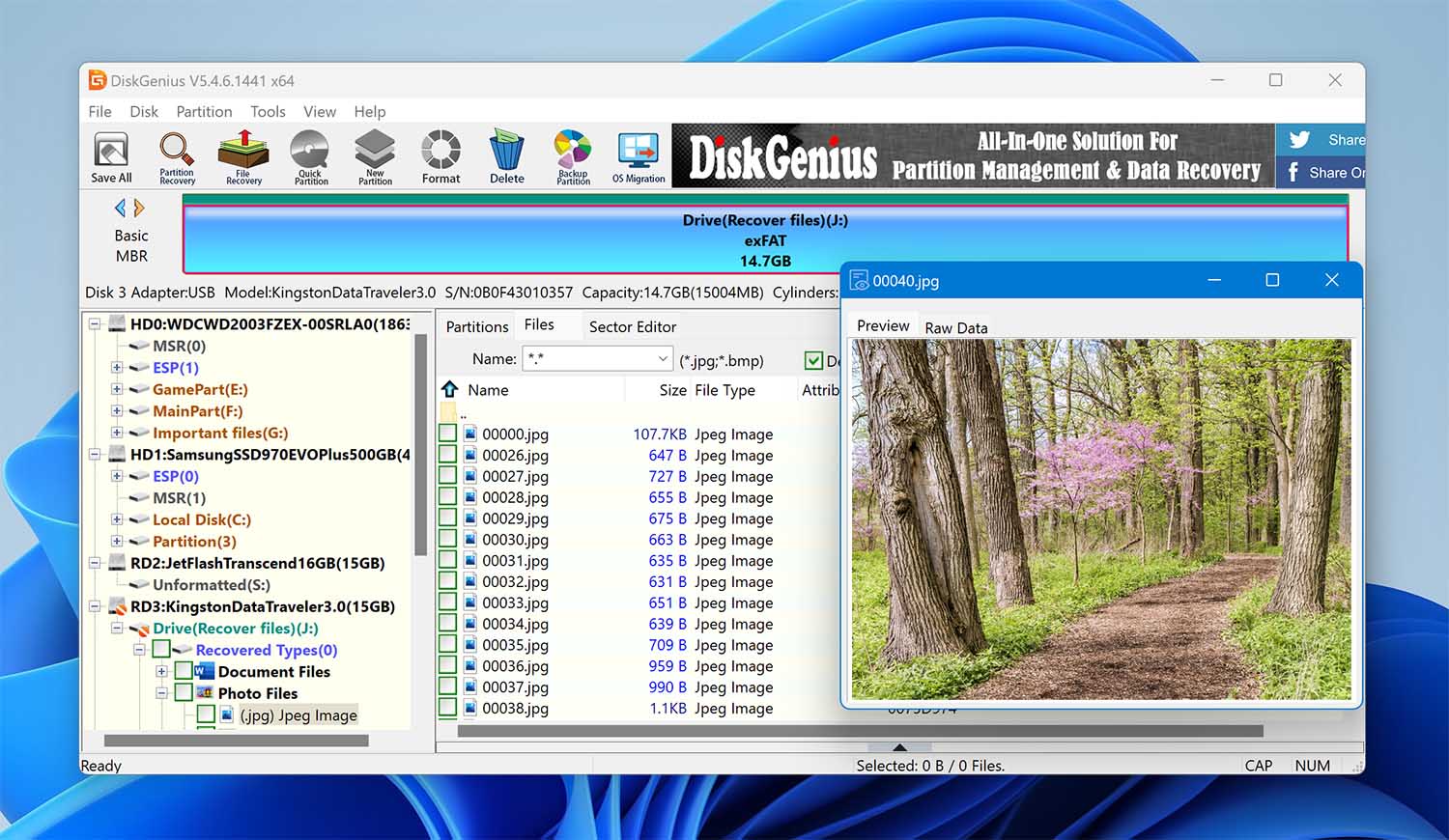

Best Data Recovery Software For Formatted Hard Disk

Whether you're after hard drive partition recoveries, formatted hard drive recoveries, recovering deleted files or RAW files, Easeus Data Recovery Wizard Pro. Recover Deleted, Lost, Formatted & Corrupt Files Easily · Recover data from PC, Hard Drive, USB, SD Cards, and other external devices. · Supports unlimited file. There are various data recovery software options available, such as Wondershare Recoverit, EaseUS Data Recovery Wizard, Disk Drill, and Recuva. Eassos DiskGenius offers an easy-to-use solution to recover deleted and lost files. Just only simple steps will find out your lost data. It is able to recover. Summary: About how to use the best hard drive data recovery software or services to recover lost files and repair the corrupted disks with efficient fixes. R-TT offers disk recovery software and hard drive data recovery tools. Network and RAID support. Recuva is a % free data recovery software for Windows PC. You can use Recuva to undelete files from hard drive, recycle bin, digital camera card, and USB. We will attempt to recover your deleted photos, music and files from a working drive, or data that was lost because a drive was reformatted. There is a chance. Download the ten best format hard disk data recovery software - EaseUS data recovery software to recover files from the formatted hard drive for free. Whether you're after hard drive partition recoveries, formatted hard drive recoveries, recovering deleted files or RAW files, Easeus Data Recovery Wizard Pro. Recover Deleted, Lost, Formatted & Corrupt Files Easily · Recover data from PC, Hard Drive, USB, SD Cards, and other external devices. · Supports unlimited file. There are various data recovery software options available, such as Wondershare Recoverit, EaseUS Data Recovery Wizard, Disk Drill, and Recuva. Eassos DiskGenius offers an easy-to-use solution to recover deleted and lost files. Just only simple steps will find out your lost data. It is able to recover. Summary: About how to use the best hard drive data recovery software or services to recover lost files and repair the corrupted disks with efficient fixes. R-TT offers disk recovery software and hard drive data recovery tools. Network and RAID support. Recuva is a % free data recovery software for Windows PC. You can use Recuva to undelete files from hard drive, recycle bin, digital camera card, and USB. We will attempt to recover your deleted photos, music and files from a working drive, or data that was lost because a drive was reformatted. There is a chance. Download the ten best format hard disk data recovery software - EaseUS data recovery software to recover files from the formatted hard drive for free.

Summary:With the help of Bitwar Data Recovery, you can recover shift deleted files and falsely formatted drive. It is a professional and conveniently recovery. Recover files after format/virus attack/ inaccessible digital device; · Raw file system or drive shows 0 bytes; · chkdsk reports raw drive; · Disk/drive/card. Do Your Data Recovery Pro, the best hard drive data recovery software, supports to recover lost data from PC, laptop, HDD, RAID, SSD, Server, NAS, USB drive. Step 1 Open the Data Recovery Software. · Step 2 Select Formatted Data Recovery Mode. · Step 3 Choose the specific partition and the software will. Download the ten best format hard disk data recovery software - EaseUS data recovery software to recover files from the formatted hard drive for free. Data Recovery Tool to Recover Lost & Deleted Data from Crashed, Formatted, Corrupted Device · Restore & Recover Data from External Hard drives, PCs, Removable. Top 1: 4DDiG Data Recovery · High 98% data recovery rate · Broad device and file format compatibility · Multiple scan modes for versatile data recovery · Easy-to-. You can use EaseUS Data Recovery Wizard on multiple devices, including laptops, hard drives, PCs, digital cameras, video players, and pen drives. This software. With its intelligent data recovery engine, DiskGeeker can quickly scan all deleted or formatted data on any disk. It can be a hard drive, SSD, USB flash drive. Recuva is a % free data recovery software for Windows PC. You can use Recuva to undelete files from hard drive, recycle bin, digital camera card, and USB. Part 2. Top 10 Formatted Hard Drive Data Recovery Software · Deep Data Recovery · Recuva · Disk Drill · OnTrack EasyRecovery · R-Studio · TestDisk · Puran Data. Lost your data from the hard drive? Presenting one of the best hard drive recovery software available in the market - SFWare Data Recovery. This tool can be. Best Data Recovery Software of 1. Cleverfiles Disk Drill Data Recovery 2. EaseUS 3. Stellar Data Recovery 4. Kernel Data Recovery 5. DoYourData 6. Best Data Recovery Software of 1. Cleverfiles Disk Drill Data Recovery 2. EaseUS 3. Stellar Data Recovery 4. Kernel Data Recovery 5. DoYourData 6. Best Data Recovery Software of · Can typically recover files from corrupt, damaged, deleted, or reformatted drives · Works with internal and external drives. Sarbasish Basu on how2shout reviewed the hard disk recovery wizard and rated it best tool to restore deleted, formatted and corrupted data from hard disk drive. Advik Data Recovery Software is the only savior that has an ability to recover formatted hard drive data with ease. All you have to do is follow these 3 easy. Best unformat software – DiskGenius. In order to unformat hard drive, you need special hard drive unformat software. The unformat software will scan your hard. Recovery from damaged disks. Unlike most file recovery tools, Recuva can recover files from damaged or newly formatted drives. Greater flexibility means greater.

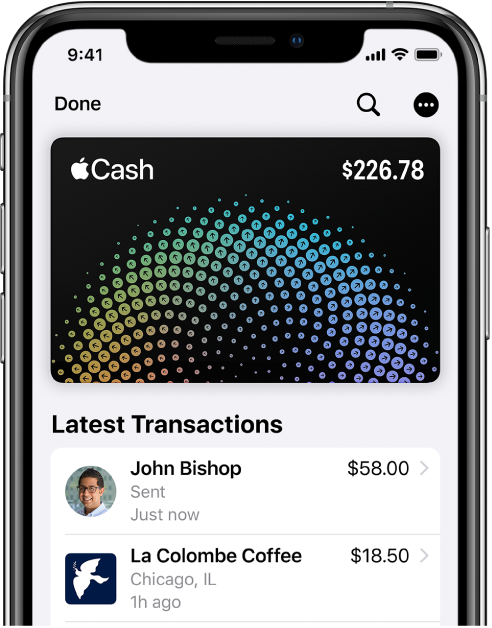

Cash App Card To Apple Pay

Yes, you can verify your Cash App card for Apple Pay. There are two ways for doing so which include through Cash App or through your Apple Pay wallet. Get started when you load your Wallet with cash, credit, debit, 7-Eleven gift cards, Apple Pay® or Google Pay®. Get The App · 7REWARDS · 7-Eleven Wallet · Fuel. Transfer funds from Cash App to your bank account, and then transfer from your bank to Apple Cash is one way. You may also add a card using the Wallet app or within the Wallet & Apple Pay settings of your compatible device. Currently, the following cards are eligible. Apple Pay and Google Pay To add your Cash App Card to Apple Pay: Go to the Card tab on your Cash App home screen. Select Add to Apple Pay. Cash App is the #1 finance app in the App Store. Pay anyone instantly. Save when you spend. Bank like you want to. Buy stocks or bitcoin with as little as. Open the Cash App, go to the Cash Card tab, and tap "Add to Apple Wallet." Follow the on-screen instructions to complete the process. Withdraw. Yes! You can add your Family Cash Card to your Apple Wallet, Google Pay, Venmo, Cash App, or Venmo and use it to make online purchases or make contactless. Apple Cash is a digital card in Wallet that lets you send and receive money in Messages or Wallet. The money you receive appears on your Apple Cash card in. Yes, you can verify your Cash App card for Apple Pay. There are two ways for doing so which include through Cash App or through your Apple Pay wallet. Get started when you load your Wallet with cash, credit, debit, 7-Eleven gift cards, Apple Pay® or Google Pay®. Get The App · 7REWARDS · 7-Eleven Wallet · Fuel. Transfer funds from Cash App to your bank account, and then transfer from your bank to Apple Cash is one way. You may also add a card using the Wallet app or within the Wallet & Apple Pay settings of your compatible device. Currently, the following cards are eligible. Apple Pay and Google Pay To add your Cash App Card to Apple Pay: Go to the Card tab on your Cash App home screen. Select Add to Apple Pay. Cash App is the #1 finance app in the App Store. Pay anyone instantly. Save when you spend. Bank like you want to. Buy stocks or bitcoin with as little as. Open the Cash App, go to the Cash Card tab, and tap "Add to Apple Wallet." Follow the on-screen instructions to complete the process. Withdraw. Yes! You can add your Family Cash Card to your Apple Wallet, Google Pay, Venmo, Cash App, or Venmo and use it to make online purchases or make contactless. Apple Cash is a digital card in Wallet that lets you send and receive money in Messages or Wallet. The money you receive appears on your Apple Cash card in.

Sign out of Cash App BUT remove the card from your Apple Pay Wallet before you sign out of iCloud on your iPhone and Cash App! Reply reply. Select Cash App Pay and enter the ZIP code for your CashApp payment method. Check the subscription agreement box, then click Start free trial. Tap Open if you. Simply swipe or tap your credit card, debit card or smart device with Apple Pay or Google Pay where you would normally use cash. It's faster, safer and. From the Apple Pay Cash app, use your Fidelity account and routing numberLog In Required OR your Fidelity debit or credit cards to link to your Fidelity account. 1. Tap the Cash Card tab on your Cash App home screen · 2. Tap the image of your Cash Card · 3. Select Add to Apple Pay · 4. Follow the steps. This can be done by tapping on the Wallet app icon on your home screen. Tap on the "Add Card" option to add a new credit or debit card to your Apple Wallet. In your Wells Fargo Mobile app, tap Menu in the bottom bar, select Card Settings, then tap Digital WalletFootnote 3. All eligible digital wallets will display. Add money from cash app card to Apple wallet. Actually worked for me. Might work with the android wallet equivalent. Cash App is the easy way to send, spend, save, and invest* your money. Download Cash App and create an account in minutes. SEND AND RECEIVE MONEY INSTANTLY. Cash App Pay uses the customer's stored balance or linked debit card to fund the payment. The customer can confirm the payment in one of two ways: During. Apple Vision Pro: Open the Settings app, tap Wallet & Apple Pay, tap your Apple Cash card, then tap Add Money. Enter an amount. The minimum is $ Tap Add. It is currently not possible to transfer money from Cash App to Apple Pay, because Apple Pay is not a bank account. It is an electronic wallet with which you. Even if you do not have a card, you can transfer your funds from Apple Pay to Cash App using your bank account as an intermediary. How long does it take to. The Apple Pay Cash app is connected to the usual Apple To register, users can sign up with Apple Pay and link a payment card through the Apple Wallet app. Cash App is the easy way to send, spend, save, and invest* your money. Download Cash App and create an account in minutes. SEND AND RECEIVE MONEY INSTANTLY. The Cash App Card is a free, customizable debit card that is connected to your Cash App balance. It can be used anywhere Visa is accepted, both online and in. All of this syncs with the tech giant's other payment service — Apple Pay®. This allows you to use a single unified system for both retail purchases and P2P. Cash App Pay simplifies in-person and online transactions, providing customers an easy and contactless way to pay. If you have a Cash App card connected to your Cash App account, you can easily add it to Google Pay or Apple Pay—even if you don't have the physical card. Then. Select Cash App Pay as your payment method during checkout · For mobile, you'll be redirected to Cash App from the merchant's checkout. For desktop, scan the QR.

Robo Advisor Vs Traditional

Robo-advisors are digital platforms that provide automated, algorithm-driven financial planning services with minimal human supervision. Most robo advisory firms charge between % and % as an annual asset management fee – a bargain compared to the % which many traditional advisors. Lower Fees - Robo-advisors usually have much lower fees than traditional advisors, which makes them appealing especially for beginners or people. What is a robo-advisor? are digital services that provide basic money management functions and develop a diversified portfolio for clients using an algorithm. Lower fees compared with a traditional financial advisor · Lower capital required to start · The ability to avoid human error and bias · Automatic rebalancing · No. The authors empirically show that robo-advice investors save over 4% a year in direct and indirect costs compared with traditional solutions, such as advisory. Both robo-advisors and traditional advisors have their own benefits. Think about your investment objectives, comfort level with risk, and financial resources. The key difference is that robo-advisors, as they sound, aren't actually people, but rather automated algorithms that provide a management service, rather than. This type of personal contact is relegated to the traditional financial advisory models. Most robo-advisors won't hold your hand and comfort you after a. Robo-advisors are digital platforms that provide automated, algorithm-driven financial planning services with minimal human supervision. Most robo advisory firms charge between % and % as an annual asset management fee – a bargain compared to the % which many traditional advisors. Lower Fees - Robo-advisors usually have much lower fees than traditional advisors, which makes them appealing especially for beginners or people. What is a robo-advisor? are digital services that provide basic money management functions and develop a diversified portfolio for clients using an algorithm. Lower fees compared with a traditional financial advisor · Lower capital required to start · The ability to avoid human error and bias · Automatic rebalancing · No. The authors empirically show that robo-advice investors save over 4% a year in direct and indirect costs compared with traditional solutions, such as advisory. Both robo-advisors and traditional advisors have their own benefits. Think about your investment objectives, comfort level with risk, and financial resources. The key difference is that robo-advisors, as they sound, aren't actually people, but rather automated algorithms that provide a management service, rather than. This type of personal contact is relegated to the traditional financial advisory models. Most robo-advisors won't hold your hand and comfort you after a.

In reality, a robo-advisor, “is a service that uses highly specialized software to do the job of wealth managers or investment advisors – people who decide what. Financial Advisor/Coach | The Financial Gym · Our Services · 1-on-1 Coaching Message from the CEO - Setbacks vs. Comebacks. Aug 6, Message from the. Robo advisors are often viewed as a more affordable and accessible alternative to traditional financial advisors, as they typically charge lower fees and. While different robo-advisors have varying fee structures, with Schwab Intelligent Portfolios, you'll pay no advisory fee and no commissions. However, as with. The only difference between a personal advisor and Wealthfront is that Wealthfront does not know your full financial situation, so the platform. Lower Fees - Robo-advisors usually have much lower fees than traditional advisors, which makes them appealing especially for beginners or people. Rather than investing using traditional brick and mortar storefronts, with human advisors helping clients invest their money, robo advisor use technology and. For me, Robo advisors offer more honest and concise advises compared to traditional financial advisors. They assure that they can do what they. You pay less than working with a traditional financial advisor, but you get less in terms of human interaction and planning advice. With a robo-advisor, you'll. Robo-advisors provide mostly passive market access with strategic asset allocations versus traditional investment advisors offering active market calls. Robo‑Advisors. Ideal for a single investment goal; Stay on track to individual goals with automated portfolio rebalancing ; Robo + Traditional. Ideal for an. While traditional financial planning firms typically charge between 1 and 2% of assets under management (or the rough equivalent in fees), today's robo-advisors. The catch here that no one really discusses is that unlike financial advisors who work in traditional brokers, those hired by robo advisors are not always as. While costs can vary, robo advisors are typically a more affordable option than traditional investment management. Some robo advisors offer additional financial. A robo-advisor is a financial advisor that uses an algorithm to automatically select investments for you. The investment choices are based on things such as. The key difference is that robo-advisors, as they sound, aren't actually people, but rather automated algorithms that provide a management service, rather than. If you're this kind of hands-off investor, choosing a robo-advisor could be a great choice for your investing dollars. Robos use automation and software to. Robo-advisors are a digital platform that uses algorithms to act as an automated, low-cost alternative to traditional financial advisors. A robo-advisor, also known as a digital wealth advisor, uses computer algorithms to help you asset allocate and manage your money. Robo-advisors or robo-advisers are a class of financial adviser that provide financial advice and investment management online with moderate to minimal.

Buying Stock Shares For Dummies

Then, once you've added money to the account, you can purchase and sell a stock, hold the shares and collect any dividends that are paid. Choose the shares you. Stock Exchanges for Beginners Stock exchanges facilitate stock trading among investors – they give investors the ability to buy and sell their shares. That's. Stocks are a type of security that gives stockholders a share of ownership in a company. Companies sell shares typically to gain additional money to grow the. Stock Market Basics: Guide for Beginners · What Is a Stock? A stock is like a piece of a company that you can buy. · What Is the Share Market? · How Does the Stock. When people talk about investing in stocks, they're usually referring to common stock. These kinds of stocks give you the opportunity to join in the success of. The Investing for Beginners Podcast - Your Path to Financial Freedom. By Andrew Sather and Dave Ahern | Stock Market Guide to Buying Stocks like. Follow. We. Stocks are a type of security that gives stockholders a share of ownership in a company. Companies sell shares typically to gain additional money to grow the. A stock represents a share in the ownership of a company, including a claim on the company's earnings and assets. How to Buy Stocks for Beginners. Views 32KJul 2, Then, once you've added money to the account, you can purchase and sell a stock, hold the shares and collect any dividends that are paid. Choose the shares you. Stock Exchanges for Beginners Stock exchanges facilitate stock trading among investors – they give investors the ability to buy and sell their shares. That's. Stocks are a type of security that gives stockholders a share of ownership in a company. Companies sell shares typically to gain additional money to grow the. Stock Market Basics: Guide for Beginners · What Is a Stock? A stock is like a piece of a company that you can buy. · What Is the Share Market? · How Does the Stock. When people talk about investing in stocks, they're usually referring to common stock. These kinds of stocks give you the opportunity to join in the success of. The Investing for Beginners Podcast - Your Path to Financial Freedom. By Andrew Sather and Dave Ahern | Stock Market Guide to Buying Stocks like. Follow. We. Stocks are a type of security that gives stockholders a share of ownership in a company. Companies sell shares typically to gain additional money to grow the. A stock represents a share in the ownership of a company, including a claim on the company's earnings and assets. How to Buy Stocks for Beginners. Views 32KJul 2,

Now, we aren't saying you will make $8 million. After all, this is a beginners book and the janitor had an extraordinary result. But stock market investing is. Investing for beginners. What is investing? Investing is about trying to do When you buy a share on the stock market, you aren't buying it directly. Stocks are commonly known as “equities” · Companies sell stock to raise money for their operations · Typically, stocks trade on exchanges such as the NYSE or. When you invest in stock, you buy ownership shares in a company—also known as equity shares. Your return on investment, or what you get back in relation to. Stocks for Dummies Look at investopedia for some educational resources. Learn limit and market orders. Get an brokerage acct with Ameritrade. Investing for beginners Principles for good investing Life events Tax allowances Investing in shares Dealing fees and charges Stock plan transfer. Investing for beginners. Investing for beginners. 10 need-to-knows to get you A stock market is like a supermarket where you can buy or sell shares. Neopets Stock Market for Dummies · Withdraw up to 15,nps from the bank. This is your DAILY investment. · To get started, we need to buy shares. The process of stock trading for beginners · 1. Open a demat account · 2. Understand stock quotes · 3. Bids and asks · 4. Fundamental and technical knowledge of. How to start investing | Investing for beginners | Fidelity. Clicking a link market exists for the ETP's shares when attempting to sell them. Each. 5 Top Tips on Investing in Stocks for Beginners · 1. Define your investing goals · 2. Set yourself up for success · 3. Look for a wide moat when investing · 4. Investing For Dummies and the first five editions of Stock Investing For Dummies. markets and stock market analysis. Good book for beginners. The book. For most people, buying shares is not about trying to outsmart the market or get rich quick Share investing for absolute beginners. To a first-time investor. Stock trading strategies for beginners include day trading, swing trading, and position trading, each offering unique approaches to trading securities within. Stock trading for beginners involves considering your overall investment aims and your reasons for investing. Your risk-profile will dictate which types of. Listen to By Andrew Sather and Dave Ahern | Stock Market Guide to Buying Stocks like's The Investing for Beginners Podcast - Your Path to Financial Freedom. As a beginner, you should start investing in Blue chip stocks to understand and experience the stock market. Blue chip stocks are a much safer. Revolut's stock trading products are provided by Revolut Trading Ltd (No. ), an appointed representative of Resolution Compliance Ltd, which is. Learn everything you can about how the stock market works and stock market investing basics. Understand the industry and know how to value a stock and invest to. You can buy and sell stocks through: Direct stock plans. Some companies allow you to buy or sell their stock directly through them without using a broker.

Best Credit Card To Rollover Balance

The best Chase balance transfer card is Slate Edge® credit card because it offers an introductory APR of 0% for 18 months on both balance transfers and. A balance transfer credit card lets you move what you owe from one or more credit cards to a new one with a different provider. Because it typically has a lower. Best for low-cost balance transfers: BankAmericard® credit card; Best credit union card: Gold Visa® Card. Filter by: All cards. No annual fee. Welcome. Video Transcript for Balance Transfers. Text: A balance transfer could be a great tool to save money on interest and pay off credit card debt faster. An. You could pay less interest by transferring balances from other higher-rate credit cards to a Wells Fargo Credit Card. A balance transfer lets you use a credit card to pay debt on another credit card. This could save you money if you're moving the balance to a card with a much. U.S. Bank Visa® Platinum Card *: Best Balance Transfer Card With a Long Payoff Window; Citi Double Cash® Card: Best Balance Transfer Credit Card for Fair Credit. Best Card for Balance Transfer? · discover 3% transfer fee and 0% apr for 18 months · wells Fargo 3% transfer fee and 0% for 15 months · wells. Best balance transfer credit cards of September ; Citi Simplicity® Card · Wells Fargo Reflect® Card · Citi® Diamond Preferred® Card ; Discover it® Chrome. The best Chase balance transfer card is Slate Edge® credit card because it offers an introductory APR of 0% for 18 months on both balance transfers and. A balance transfer credit card lets you move what you owe from one or more credit cards to a new one with a different provider. Because it typically has a lower. Best for low-cost balance transfers: BankAmericard® credit card; Best credit union card: Gold Visa® Card. Filter by: All cards. No annual fee. Welcome. Video Transcript for Balance Transfers. Text: A balance transfer could be a great tool to save money on interest and pay off credit card debt faster. An. You could pay less interest by transferring balances from other higher-rate credit cards to a Wells Fargo Credit Card. A balance transfer lets you use a credit card to pay debt on another credit card. This could save you money if you're moving the balance to a card with a much. U.S. Bank Visa® Platinum Card *: Best Balance Transfer Card With a Long Payoff Window; Citi Double Cash® Card: Best Balance Transfer Credit Card for Fair Credit. Best Card for Balance Transfer? · discover 3% transfer fee and 0% apr for 18 months · wells Fargo 3% transfer fee and 0% for 15 months · wells. Best balance transfer credit cards of September ; Citi Simplicity® Card · Wells Fargo Reflect® Card · Citi® Diamond Preferred® Card ; Discover it® Chrome.

You may pay a balance transfer fee (which typically ranges from 3%–5% of the transfer amount), though some credit card companies may waive these fees. The. Wells Fargo Reflect® Card The Wells Fargo Reflect® Card is one of the best options if you want to save money on credit card interest and not pay an annual fee. A balance transfer is a credit card feature that allows you to move debt from one credit card account to another. While most credit cards allow you to request a. Choice One VISA Classic and Platinum Credit Cards feature 0% APR* on balance transfers for 6 months with no balance transfer or annual card fees. Discover it Chrome · Citi Diamond Preferred Card · Blue Cash Preferred Card from American Express · Blue Cash Everyday Card from American Express · Citi Simplicity. If you want to pay off credit card debt faster, a balance transfer is a great option. Consolidate multiple credit cards into one monthly payment, and pay it off. A balance transfer credit card moves your outstanding debt from one or more credit cards onto a new card, typically with a lower interest rate. Slate Edge credit card. · Slate Edge credit card · Chase Freedom Unlimited credit card. · Chase Freedom Unlimited credit card card reviews. Rated out of 5 . Summary of the best balance transfer cards. Citi® Diamond Preferred® Card *: Best for longer transfer window. Wells Fargo Reflect® Card*: Best balance transfer. You want 0% APR for as many months as you can qualify for with your credit score (this is why you need good credit); Once you have the card, move your balances. Pay down credit card debt with a balance transfer card and get up to 15+ months in 0% intro APR. Compare balance transfer credit card offers. The Wells Fargo Reflect lets you skip interest on purchases and balance transfers for 21 months. 5 min read Jul 09, Shot of a young. A balance transfer is a method of debt consolidation where you combine existing credit card debt and other qualifying debts within one single credit card. This. MBNA True Line® Mastercard® Welcome offer: You could get a 0% promotional annual interest rate (“AIR”) for 12 months on balance transfers completed within Citi simplicity currently has a 3% transfer on a 0% apr for 21 months. Transferring almost 5k and my transfer fee was $ that's basically. Longest balance transfer intro offer. Balance Transfer Credit Cards · Citi® Diamond Preferred® Card · Citi Double Cash® Card · Citi Rewards+® Card · BMO Platinum Credit Card · Key2More Rewards® Credit. Don't close your original credit card account. Even if you don't plan to use the credit card that you transferred a balance from, don't close it. Having that. Simply transferring a balance to an existing card won't affect your score. But using your card responsibly—by making on-time payments and paying down the. Balance transfers are a unique tool to consolidate and reduce debt. Here are Canada's top credit card balance transfer offers with low interest rates and.

Suze Orman Stock Picks

The Best Guaranteed Investment Boost. If you have been invested in U.S. stocks the past few years you have no doubt made some serious money. The U.S. markets. Today's Suze School episode picks up with the lesson Suze taught last Sunday about dividend paying stocks. What happens when the stock you own goes down? In this episode, Suze goes deep on what investments, like dividend paying stocks, you should consider having in your retirement accounts. Stocks And Bars The Stock Market Hip Hop Podcast Cliff Notes Episode – The Two Tips To Manage Your Money, Stock Picks and More! Suze Orman's Women & Money . Picking And Choosing Stocks. Investors Business Daily developersjp.online ; Online Trading. Muriel Siebert () developersjp.online ; Companies You Can Buy. Like ARKK. The biggest mistakes I've made in the stock market are taking her advice on ARKK and The Motley Fool's advice on BAND. The only two picks I didn't. Podcast Episode - Suze's Financial Predictions On this podcast, Suze gives us her financial predictions, focusing on the Stock Market and real estate. Suze Orman Says This Is the Age You Should Retire—Not a Month or Year Before Top Stock Picks for , According to People Who Have Beaten the Market. Suze Orman is Bullish On The Stock Market (But Her Money is Elsewhere) One of the cornerstones of Suze's advice is investing in the stock market. The Best Guaranteed Investment Boost. If you have been invested in U.S. stocks the past few years you have no doubt made some serious money. The U.S. markets. Today's Suze School episode picks up with the lesson Suze taught last Sunday about dividend paying stocks. What happens when the stock you own goes down? In this episode, Suze goes deep on what investments, like dividend paying stocks, you should consider having in your retirement accounts. Stocks And Bars The Stock Market Hip Hop Podcast Cliff Notes Episode – The Two Tips To Manage Your Money, Stock Picks and More! Suze Orman's Women & Money . Picking And Choosing Stocks. Investors Business Daily developersjp.online ; Online Trading. Muriel Siebert () developersjp.online ; Companies You Can Buy. Like ARKK. The biggest mistakes I've made in the stock market are taking her advice on ARKK and The Motley Fool's advice on BAND. The only two picks I didn't. Podcast Episode - Suze's Financial Predictions On this podcast, Suze gives us her financial predictions, focusing on the Stock Market and real estate. Suze Orman Says This Is the Age You Should Retire—Not a Month or Year Before Top Stock Picks for , According to People Who Have Beaten the Market. Suze Orman is Bullish On The Stock Market (But Her Money is Elsewhere) One of the cornerstones of Suze's advice is investing in the stock market.

Suze Orman recommends dividend stocks above other types of equities because they pay out reliably.

Motley Fool Stock Picks · Trending Stocks · Sports Stock Ideas Author and television personality Suze Orman is well known in the personal finance space. How to Build the Best (k) Investment Portfolio. Exchange Ten years ago Suze Orman gave solid advice to match what was happening in the economy. No article about finance programming would be complete without mentioning financial guru Suze Orman. Unfortunately, she ended her year CNBC show in As part of this, the stock is split into A stock and B stock. Suze Orman recommended a Roth IRA over a traditional because % of. When to Buy, When to Sell · 1. Keep a close watch over your stock, paying attention to the daily volume of shares traded. · 2. Watch for a split: When a company. In this episode, Suze goes deep on what investments, like dividend paying stocks, you should consider having in your retirement accounts. investment play you can make. To ask Suze a question, go to developersjp.online More Financial Advice. Suze Orman's 4 tips for choosing health insurance. picks; articles and projections from various economic experts; rates on Suze Orman's Invest for Success," on CNBC. She appears regularly on QVC as. Orman's fifth major book has perfect timing. As many Americans grapple with unemployment, diminished (k)s, crumbling stock market holdings and seemingly. best investments I've ever made (and thank you to Suze Orman for recommending you on her podcast multiple times). I wish I had done something like this much. Podcast Episode - A Super Financial Game Plan, Part 2. Today's Suze School episode picks up with the lesson Suze taught last Sunday about dividend paying stocks. Savvy money matron Orman knows her financial advice. Get Moby's top stock picks and join 10M+ investors making better, informed investment decisions today. Find the perfect suze orman stock photo, image, vector, illustration or image. Available for both RF and RM licensing. How good are his stock picks and advice? Read More · The Beardstown Update: Suze Orman's Financial Advice and Career. Apr 22, Is Suze Orman. Suze Orman, “always insightful” by Constellation Research CEO Wall Street models are busted and picking the right stocks is more critical than ever. Years ago, retirees typically traded stocks for bonds after retiring. Pensions were common, bond interest rates were higher, and people lived shorter lives. Suze Orman's Women & Money (And Everyone Smart Enough to Listen). S1.E All Top picks. Sign in to rate and Watchlist for personalized. stock picks — MarketWatch. This robot-run fund with a history of predicting Tesla price moves has just made these stock picks — MarketWatch. investment advice investment tip investment tips stockbroker stockbrokers stock broker stock brokers suze orman. keywords nav right. Use This Cartoon. Suze. stock picks rarely beats that of the market as a whole. Dave Ramsey's methods may help you spot and correct poor spending habits. At the same time, Suze.