developersjp.online

Learn

Stock Trading Algorithms For Sale

Algorithmic Trading. Open menu Retail traders pick the wrong stocks, so put spreads are the the weapon of choice. The order types and algos available on our platform help traders implement algorithmic trading strategies and may help limit risk, speed execution, support. Multiple Types of Trading Strategies Are Used in Our Automated Trading Software · Day Trade V1 & V2 · Emerald Day Trading Algorithm · Geronimo ES Trading Algorithm. If the algorithm determines that the news is likely to have a positive impact on the stock price, it could execute a buy order for the stock. Alternatively. Algorithmic trading, also known as automated trading, is a process in which computers use complex mathematical algorithms to make split-second buy and sell. It provides a marketplace where traders and strategy developers can create, share, and deploy their trading algorithms without the need for extensive. 1. Online marketplaces: There are several online marketplaces where traders can purchase or subscribe to pre-built trading algorithms. Some. Imagine a stock's price is on the rise — the algo trading software will say, “Buy that now!” You buy the stock, ride the wave as it goes up, and. Execute your Trading Algos Commission-Free. Trade stocks, ETFs, and options with zero commissions. Plus, business and personal accounts are both supported. Algorithmic Trading. Open menu Retail traders pick the wrong stocks, so put spreads are the the weapon of choice. The order types and algos available on our platform help traders implement algorithmic trading strategies and may help limit risk, speed execution, support. Multiple Types of Trading Strategies Are Used in Our Automated Trading Software · Day Trade V1 & V2 · Emerald Day Trading Algorithm · Geronimo ES Trading Algorithm. If the algorithm determines that the news is likely to have a positive impact on the stock price, it could execute a buy order for the stock. Alternatively. Algorithmic trading, also known as automated trading, is a process in which computers use complex mathematical algorithms to make split-second buy and sell. It provides a marketplace where traders and strategy developers can create, share, and deploy their trading algorithms without the need for extensive. 1. Online marketplaces: There are several online marketplaces where traders can purchase or subscribe to pre-built trading algorithms. Some. Imagine a stock's price is on the rise — the algo trading software will say, “Buy that now!” You buy the stock, ride the wave as it goes up, and. Execute your Trading Algos Commission-Free. Trade stocks, ETFs, and options with zero commissions. Plus, business and personal accounts are both supported.

It provides a marketplace where traders and strategy developers can create, share, and deploy their trading algorithms without the need for extensive. traders do not have to reinvent the wheel if their trading algorithms involve a sell-off in the stock market—a nice demonstration of the meaning of. traders do not have to reinvent the wheel if their trading algorithms involve a sell-off in the stock market—a nice demonstration of the meaning of. With Swastika Algo Trading Platforms, get access to powerful, computer-assisted programs that follow your instructions, buy and sell stocks based on predefined. QuantConnect is a multi-asset algorithmic trading platform chosen by more than quants and engineers. Do Not Sell/Share. Learn Anywhere. Placeholder. © Coursera Inc. All rights reserved. SpeedBot an Algorithmic Trading Platform will help you make fortunes in the stock market without direct knowledge of stocks, options, futures, and other. Enjoy Tickblaze, a hybrid trading platform for stocks, forex, futures, and crypto. Open to day traders and quants. day free trial! Algorithm stock trading will also help to analyze huge layers of information on various cryptocurrency exchanges and find the best offer, and then conduct a buy. Algorithmic trading courses can show you how to create trading bots for exchanging stocks, Bitcoin, and many other financial assets. Join hundreds of thousands. Learn about algorithmic trading, including what it is, why use it and some algorithmic trading strategies which you might find helpful. Algorithmic trading is a modern investment strategy that uses computer programs to execute trades based on mathematical algorithms and market data. In recent. FINRA Requests Comment on a Proposal to Publish OTC Equity Volume Executed Outside Alternative Trading Systems Sale Eligible. 11/12/ Regulatory. The order types and algos available on our platform help traders implement algorithmic trading strategies and may help limit risk, speed execution, support. If the algorithm determines that the news is likely to have a positive impact on the stock price, it could execute a buy order for the stock. Alternatively. Presently, algorithmic trading is dominated by institutional traders and investors — traders who trade for a group or institution and buy and sell stocks on. Alpaca's easy to use APIs allow developers and businesses to trade algorithms, build apps and embed investing into their services. Quantower can trade on different markets and shares the best trading strategies among them all. This allows you to use features such as Volume analysis to trade. The use of our services, including algorithmic trading strategies, Phoenix Investments in securities and equity-related instruments are subject to various. When the price is approaching a Demand Zone the system sends instant unbiased day trading alerts to all subscribers. How Does it Work: The algorithm identifies.

How Much Does A Jet Cost

How much does it cost to hire a private jet with AEROAFFAIRES? ✈ Expert air charters since ✓ Best rates ✓ 24/7 ✓ Safe and efficient. Understanding Private Jet Charter Pricing ; TurboProp, $1, - $2, · $ ; Very Light Jet, $2, - $2, · $ ; Light Jet, $2, -. Understanding the cost of buying a private jet is essential for informed decisions. Prices range from $2 million to over $ million. Private jet operating costs can vary considerably depending on the size and type of jet, the number of hours flown, and the price of fuel. Planes in this category include heavy jets such as the Challenger and Gulfstream G4 ($8,$10,/hour), and long range jets such as the Global Express. The cost to charter a private flight in starts at around $2, an hour* in a turboprop, $5, an hour* in a light jet, $7, an hour* in a midsize jet. Private jets are chartered by the hour ranging from $3, to $18, per hour and vary by the size, make, model, and age of the private jet. This cost includes. Charter rates for mid-sized jets range from $3, to $4, Also, super-mid-sized jet rentals range from $3, to $6, The total cost of a mid-sized air. All told, you can figure an initial purchase price from $14 to 43 million and annual costs of $4,, As you can see, there are several options for those. How much does it cost to hire a private jet with AEROAFFAIRES? ✈ Expert air charters since ✓ Best rates ✓ 24/7 ✓ Safe and efficient. Understanding Private Jet Charter Pricing ; TurboProp, $1, - $2, · $ ; Very Light Jet, $2, - $2, · $ ; Light Jet, $2, -. Understanding the cost of buying a private jet is essential for informed decisions. Prices range from $2 million to over $ million. Private jet operating costs can vary considerably depending on the size and type of jet, the number of hours flown, and the price of fuel. Planes in this category include heavy jets such as the Challenger and Gulfstream G4 ($8,$10,/hour), and long range jets such as the Global Express. The cost to charter a private flight in starts at around $2, an hour* in a turboprop, $5, an hour* in a light jet, $7, an hour* in a midsize jet. Private jets are chartered by the hour ranging from $3, to $18, per hour and vary by the size, make, model, and age of the private jet. This cost includes. Charter rates for mid-sized jets range from $3, to $4, Also, super-mid-sized jet rentals range from $3, to $6, The total cost of a mid-sized air. All told, you can figure an initial purchase price from $14 to 43 million and annual costs of $4,, As you can see, there are several options for those.

Also, the bigger your private jet is, the more staff it may require. 2. Insurance costs - Private jets have to pay large insurance bills, and this is factored. Purchasing a heavy jet can cost anywhere from $15 million to $30 million. Ultra long range jet prices. Ultra long range jets are much larger, accommodating. Jet card programs, which begin with deposits of just $25,, or in some cases paying a membership fee, and then paying until you fly, can also be a cost-. How much does a private jet charter cost? The cost to charter a plane can range anywhere from $1, – $10, per billable flight hour. That range includes a. The total annual budget for flying a Galaxy private jet hours per year is approximately $1,, or $1,, for flying hours per year. The maximum. On average, the price of chartering a private jet is $10, per hour, depending on the type of service and location. Empty leg charter flights may cost up to. costs of fractional aircraft ownership or traditional jet card programs. GET A QUOTE. Wistia video thumbnail. THE GLOBAL LEADER IN PRIVATE JET CHARTER SERVICES. The private jet rental cost can range from $2, to $15,+ per flight hour, depending on the type of jet you hire. But besides that, there are more factors. For example, estimated fixed annual costs for a midsize private jet were quoted to range from $,–$, by leading industry sources; however, the actual. Renting a Gulfstream G plane costs about $10, per hour. For a 5-hour flight, it would be around $50, Plus, there are extra charges for landing at. How much does a private jet cost? Search for instant online prices for any private flight or call +44 (0)20 (24 hours). The cost of buying a brand-new private jet ranges from $3 million to $90 million. You can also buy secondhand jets. They are cheaper but still. The cost to charter a private flight in starts at around $2, an hour* in a turboprop, $5, an hour* in a light jet, $7, an hour* in a midsize jet. How much does a private jet cost? Search for instant online prices for any private flight or call +44 (0)20 (24 hours). Charter rates for mid-sized jets range from $3, to $4, Also, super-mid-sized jet rentals range from $3, to $6, The total cost of a mid-sized air. However, a new private jet can run anywhere from $3 million to $90 million. You'll also pay for maintenance, insurance, hangar fees, jet fuel, and. When chartering a private jet or plane, the cost per hour can be anywhere from $1, to over $13,, depending on the size and type of plane, fuel surcharges. Choosing a large jet for your luxury flights will cost you approximately $5, to $12, per flying hour. Private jet charter prices depend on several factors. Private jet charter rates can vary, but you can expect to pay an average of $1, to $3, per hour in a turboprop; $3, to $6, light jets; $5, to. These larger, more robust jets cover ranges up to 21,km. A long-haul flight such as Miami to Madrid starts from around US$, for a round trip with the.

Which Airline Stock Is Best To Buy

Airline Stocks FAQ · 1. Copa Holdings Sa (NYSE:CPA) · 2. Ryanair Holdings (NASDAQ:RYAAY) · 3. United Airlines Holdings (NASDAQ:UAL) · 1. Spirit Airlines (NYSE. Airline stocks have underperformed the broader market over the past year. · The best (and only) airline ETF is JETS. · The fund's top holdings are United Airlines. Bookmark this page to get the latest news and stock analysis of companies like Delta Air Lines (DAL), American Airlines (AAL) and United Airlines (UAL) and. 1 Best Airline Stocks To Buy. Southwest Airlines (NYSE: LUV) ; 2 Biggest Airline Stocks. American Airlines Group Inc. (NASDAQ: AAL) ; 3 Airline Stocks To. Stocks making the biggest moves midday: Ally Financial, Southwest Airlines, Oracle and more. Published Tue, Sep 10 PM EDT Updated 4 Hours Ago. Top European airline stocks · Deutsche Lufthansa · Ryanair · International Consolidated Airlines Group · Air France-KLM · easyJet. Airlines are terrible investments. Because of the high capital requirements, they are exposed to debt markets, business cycles (recessions), oil. In the US, Southwest, Delta, United, and American Airlines are easily the biggest players in the business. MarketRank™ ; SkyWest, Inc. stock logo. SKYW. SkyWest. of 5 stars / 5 stars, ; Sun Country Airlines Holdings, Inc. stock logo. SNCY. Sun Country. Airline Stocks FAQ · 1. Copa Holdings Sa (NYSE:CPA) · 2. Ryanair Holdings (NASDAQ:RYAAY) · 3. United Airlines Holdings (NASDAQ:UAL) · 1. Spirit Airlines (NYSE. Airline stocks have underperformed the broader market over the past year. · The best (and only) airline ETF is JETS. · The fund's top holdings are United Airlines. Bookmark this page to get the latest news and stock analysis of companies like Delta Air Lines (DAL), American Airlines (AAL) and United Airlines (UAL) and. 1 Best Airline Stocks To Buy. Southwest Airlines (NYSE: LUV) ; 2 Biggest Airline Stocks. American Airlines Group Inc. (NASDAQ: AAL) ; 3 Airline Stocks To. Stocks making the biggest moves midday: Ally Financial, Southwest Airlines, Oracle and more. Published Tue, Sep 10 PM EDT Updated 4 Hours Ago. Top European airline stocks · Deutsche Lufthansa · Ryanair · International Consolidated Airlines Group · Air France-KLM · easyJet. Airlines are terrible investments. Because of the high capital requirements, they are exposed to debt markets, business cycles (recessions), oil. In the US, Southwest, Delta, United, and American Airlines are easily the biggest players in the business. MarketRank™ ; SkyWest, Inc. stock logo. SKYW. SkyWest. of 5 stars / 5 stars, ; Sun Country Airlines Holdings, Inc. stock logo. SNCY. Sun Country.

Buy These Five Top Airline Stocks For Dec. 29, AM ETCPA, DAL, AM ETCPA, DAL, RYAAY, RYAAY, SKYW, LUV16 Comments 3 Likes. The Complete List of Airline Stocks on the NYSE ; 1, Alaska Air Group, Inc. ALK ; 2, Azul S.A., AZUL ; 3, China Eastern Airlines Corporation Ltd. CEA ; 4, China. NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other. There are a few ways to invest in airlines. A traditional way is through buying and selling shares on a local stock exchange. This requires you to pay the full. Top Performing Companies ; SKYW SkyWest, Inc. ; HA Hawaiian Holdings, Inc. ; UAL United Airlines Holdings, Inc. ; DAL Delta Air Lines, Inc. Airlines. Now, this made me take a step back and ask the question, would buying an airline stock be a good idea after all? Quick background. The most common valuation multiple applied to value airline stocks is EV/EBITDA. If you find an airline with better operational metrics than its peers but a. Experts suggest that the aviation industry may take years to reach complete normalcy. But major airlines stocks like American Airlines Group Inc. (ticker. Top European airline stocks · Deutsche Lufthansa · Ryanair · International Consolidated Airlines Group · Air France-KLM · easyJet. Best Airlines Stocks ; Ryanair. RYAAY, $ ; United Airlines. UAL, $ ; Hawaiian Airlines. HA, $ ; Southwest. LUV, $ That list is led by American Airlines, United Airlines, and Delta Airlines – all of whose stock has seen incredible volatility in the past three months. In the US, Southwest, Delta, United, and American Airlines are easily the biggest players in the business. Investors whose primary focus is earnings per share are likely to lean towards United Airlines stock [NASDAQ: UAL]. United enjoyed strong earnings for three. That list is led by American Airlines, United Airlines, and Delta Airlines – all of whose stock has seen incredible volatility in the past three months. Most airline stock has dropped by % over the last 3 months. Do you guys think it's safe to buy a little anticipating a late year rise? Buffet sold because the airline business model is broken. Their top sources of profits: 1. business class customers, 2. air freight, 3. the. Best Airlines Stocks Comparison | DAL, LUV, UAL, AAL, JBLU Analysis and Predictions · JetBlue Airlines (JBLU) - Stock Valuation, Analysis. Airlines Stocks: Explore the List of Best Airlines Stock Companies in India to Buy. Get Insights on Share Prices and Market Cap. Start Investing in Airlines. 1 Best Airline Stocks To Buy. Southwest Airlines (NYSE: LUV) ; 2 Biggest Airline Stocks. American Airlines Group Inc. (NASDAQ: AAL) ; 3 Airline Stocks To.

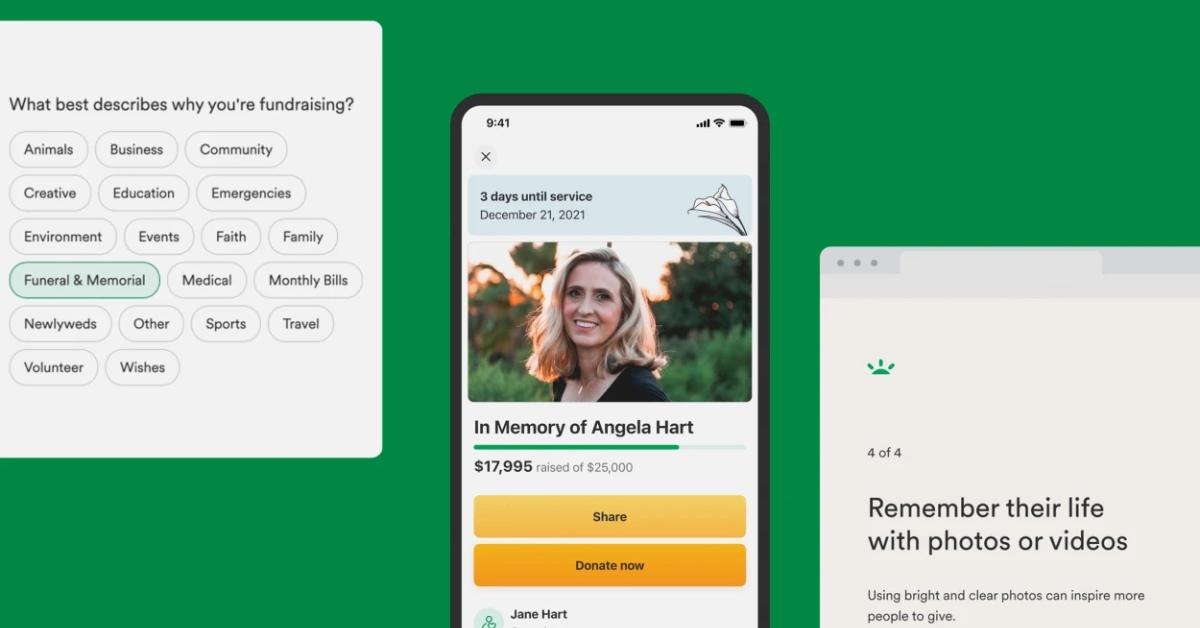

Are Gofundme Donations Taxable

GoFundMe's site includes a disclaimer that “most donations on GoFundMe are simply considered to be 'personal gifts' which are not taxed as income in the. Donations. Donations (gifts) of cash, taxable items or taxable services to an organization are not taxable sales, unless the exempt organization gives the. The money collected may be a taxation minefield, as donations can be inadvertently categorized as taxable income, and not gifts. Donations raised on GoFundMe are generally treated as gifts (GoFundMe, ). taxed (Taxable gifts, n.d.) The gift amount is adjusted every year for. Cash donations are easy – you can deduct the dollar amount of your donation. However, donating goods or products is more complex. The IRS will require you to. Well-known examples of crowdfunding sites are Kickstarter and GoFundMe. Are Contributions Made To Crowdfunding Sites Tax-Deductible as. Charitable Donations? Crowdfunding campaigns that gather donations for personal use are generally considered personal gifts and are thus not subject to taxes for the recipient. If. If the project is not fully funded and the host allows the project creator to keep all the amounts received, this income becomes taxable at the time the funds. Funds created through sites such as Kickstarter, IndieGoGo, and GoFundMe donations can be inadvertently categorized as taxable income, and not gifts. GoFundMe's site includes a disclaimer that “most donations on GoFundMe are simply considered to be 'personal gifts' which are not taxed as income in the. Donations. Donations (gifts) of cash, taxable items or taxable services to an organization are not taxable sales, unless the exempt organization gives the. The money collected may be a taxation minefield, as donations can be inadvertently categorized as taxable income, and not gifts. Donations raised on GoFundMe are generally treated as gifts (GoFundMe, ). taxed (Taxable gifts, n.d.) The gift amount is adjusted every year for. Cash donations are easy – you can deduct the dollar amount of your donation. However, donating goods or products is more complex. The IRS will require you to. Well-known examples of crowdfunding sites are Kickstarter and GoFundMe. Are Contributions Made To Crowdfunding Sites Tax-Deductible as. Charitable Donations? Crowdfunding campaigns that gather donations for personal use are generally considered personal gifts and are thus not subject to taxes for the recipient. If. If the project is not fully funded and the host allows the project creator to keep all the amounts received, this income becomes taxable at the time the funds. Funds created through sites such as Kickstarter, IndieGoGo, and GoFundMe donations can be inadvertently categorized as taxable income, and not gifts.

Generally, donations received through GoFundMe are considered personal gifts and are not taxable. However, if the funds are used for business purposes or. Even if the funds are being raised for a qualified charity, the contributors cannot deduct the donations as charitable contributions without proper. Unlike donation-based crowdfunding, funds received through rewards-based campaigns are generally taxable income to the business. However, there are exceptions. Charitable Gifts – Even if the funds are being raised for a qualified charity, the contributors cannot deduct the donations as charitable contributions without. According to the IRS, money received from crowdfunding platforms like GoFundMe is generally considered taxable income. However, charitable donations to foreign charities in countries not approved by the. IRS are not deductible. Determining how to contribute to disaster relief. Unlike donation-based crowdfunding, funds received through rewards-based campaigns are generally taxable income to the business. However, there are exceptions. In certain situations, GoFundMe donations count as taxable income. In the U.S., gifts are always tax-free to the recipient. If the GoFundMe. Lastly, what happens when tax deductible donations exceed assessable income? In general, tax deductions for donations cannot give rise to a tax loss. Like any other income, crowdfunding donations are taxable to the recipients unless there is an exception to the general rule. Fortunately, there. Donations made to personal GoFundMe fundraisers are generally considered to be "personal gifts" which, for the most part, are not taxed as. In certain situations, GoFundMe donations count as taxable income. In the U.S., gifts are always tax-free to the recipient. If the GoFundMe. It's not taxable. You do not have to stop the campaign. You are fine. They are gifts. It's not income, in any capacity. Donations by individuals to charity or to community amateur sports clubs (CASCs) are tax free. This is called tax relief. Funds received from a GoFundMe considered personal gifts to you aren't taxable income. So medical bill relief, funeral expenses, emergency funds, and most. All donations made to personal GoFundMe pages, as opposed to specific (c) charity fundraisers, are considered personal gifts — which are not guaranteed to be. Charitable contributions are generally tax deductible, though there can be limitations and exceptions. Eligible itemized charitable donations made in cash, for. As a general rule, no money received through GoFundMe is a gift. There is no charitable deduction to the giver and it is not taxable income to. Are Crowdfunding Donations Taxable? This is where it can get tricky. As the agent or person who set up the crowdfunding account, the money goes directly to. In many cases, charitable donations are tax-deductible. When you donate to a qualifying organization, you can deduct the amount from your taxable income if you.

Beneficiary Roth Ira Distribution Rules

In most cases, as a beneficiary you must empty the IRA within 10 years of that date. Exceptions: If you're the owner's spouse or minor child, chronically ill. But you may have to take RMDs every year (if you choose the life-expectancy distribution method instead of the ten-year method). I'm the sole beneficiary. Any individual beneficiary may elect to distribute the inherited IRA assets over the five years following the owner's death. The distribution must be completed. Qualified distributions from Roth IRAs are not taxable. This includes inherited Roth IRAs. However, the five-year rule still applies: If less than five years. Tax-deferred retirement plan distributions are taxed like W-2 wages in the year they are received by the beneficiary. For Roth arrangements, distributions will. However, distributions from an inherited traditional IRA are taxable. To be a qualified distribution, the money must have been in the Roth account. Keep in mind, as long as the assets have been in the original Roth IRA owner's account for 5 years or more, withdrawals are generally tax free Expand all. The tax rules are more lenient for spouse beneficiaries. Spouses can roll over the inherited IRA into their personal IRA or put the money into a new, inherited. The year rule requires that all assets in the inherited IRA must be fully withdrawn by the end of the 10th year following the original IRA owner's death. (If. In most cases, as a beneficiary you must empty the IRA within 10 years of that date. Exceptions: If you're the owner's spouse or minor child, chronically ill. But you may have to take RMDs every year (if you choose the life-expectancy distribution method instead of the ten-year method). I'm the sole beneficiary. Any individual beneficiary may elect to distribute the inherited IRA assets over the five years following the owner's death. The distribution must be completed. Qualified distributions from Roth IRAs are not taxable. This includes inherited Roth IRAs. However, the five-year rule still applies: If less than five years. Tax-deferred retirement plan distributions are taxed like W-2 wages in the year they are received by the beneficiary. For Roth arrangements, distributions will. However, distributions from an inherited traditional IRA are taxable. To be a qualified distribution, the money must have been in the Roth account. Keep in mind, as long as the assets have been in the original Roth IRA owner's account for 5 years or more, withdrawals are generally tax free Expand all. The tax rules are more lenient for spouse beneficiaries. Spouses can roll over the inherited IRA into their personal IRA or put the money into a new, inherited. The year rule requires that all assets in the inherited IRA must be fully withdrawn by the end of the 10th year following the original IRA owner's death. (If.

Am I required to pay inheritance tax on an IRA I inherited? The IRA will be subject to inheritance tax if the decedent was over 59 1/2 years old at the time. When you elect to treat the decedent's IRA as your own IRA, the distribution rules will be the same as if you'd owned the IRA all along. You can only make this. This option is helpful if the Roth IRA has not been in place for five years. Distribution rules determine that “contributions" are paid out first. This. BENEFICIARY DISTRIBUTION ELECTION (See “Rules and Conditions Applicable to Beneficiary beneficiary of a Roth IRA may transfer the original Roth IRA owner's. However, if you are the beneficiary of a Roth IRA, you may have to take distributions. See Distributions After Owner's Death in chapter 2. How are distributions. Due to passage of the SECURE Act legislation, distribution rules for IRA Successor beneficiary on either an IRA or a Roth IRA, you may be responsible. Rules for Spouses · Transfer the cash/assets into your existing IRA or a new IRA in your name. · Leave funds in the plan for as long as IRS rules allow. · Withdraw. For IRAs inherited after , the SECURE Act mandates that non-spouse beneficiaries will need to distribute the Inherited IRA within 10 years of the original. All other Roth IRA beneficiaries must comply with the year rule. The year rule requires the distribution of all assets in the account within the year. However, there are no RMDs associated with an inherited Roth subject to the 10 year rule. Multiple non-spouse beneficiaries can create separate inherited Roth. According to the SECURE Act , an inherited IRA must be paid out completely to non-spouse beneficiaries within 10 years of the death of the original IRA. Traditional, Roth, and SIMPLE IRA Beneficiary Options. When IRA Owner Dies On For Traditional and SIMPLE IRAs, the five-year rule applies if the IRA. Roth IRA. Second, the required distribution rules always apply to an inherited Roth. IRA. Third, the beneficiary steps into the deceased taxpayer's shoes and. Your distributions can be spread over time, but all assets must be withdrawn by 12/31 of the tenth year after the year in which the account holder died. Your distribution options as a beneficiary of an IRA or Roth IRA depend on a number of Required distribution rules for inherited IRAs. If you are the. Roth IRA Beneficiaries: Because Roth IRA owners are never required to The distribution rules governing inherited IRAs differ, however, based on. Non-spouse beneficiaries who inherit a Roth IRA are not required to pay taxes on their distributions, because the Roth IRA was originally funded with after-tax. Traditional Inherited IRA distributions are taxable to the Beneficiary while Roth IRA distributions are tax-free. And yes, Inherited Roth IRAs are subject. Spouse beneficiaries can roll the funds into an existing IRA account or open a new account. Required minimum distributions (RMD) rules vary based on what type. Roth IRA Beneficiaries: Because Roth IRA owners are never required to The distribution rules governing inherited IRAs differ, however, based on.

Facebook Messenger Spy App Free

That is why this tactic can be used to spy on the Messenger chats of a loved one or a family member. 3. Use a Keylogger. The term “keylogger” refers to spy. Shop whatsapp monitoring software,【 TelegramChannel:Kunghac】facebook messenger spy,khufiya camera app,spy on android phone remotely free,snapchat spy. Facebook Messenger spy app tracks the text messages sent and received in Facebook Messenger on Android phone or tablet. If you're looking for a feature-rich Facebook Messenger spy app that can show you everything, this is your best bet. Search results for 'mspy instagram spy app,【 TelegramChannel:Kunghac】santa spy cam app,hidden tracking app on phone,facebook messenger spy app,f'. ultimate iPad spy App – iKeyMonitor owns over 30 features which can help you spy on your children's or your employees' iPad by capturing screenshots. How to Read & Monitor Facebook Messenger Chats on Android & iPhone via Xnspy Xnspy app can track nine different instant messaging and dating. Spy Facebook messages of any android Mobile for FREE with Facebook Tracking. Track Facebook, Whatsapp, WeChat, Instagram, SMS messages, Location and many. Spapp Monitoring is the most advanced tracking app for Android. Spapp Monitoring records all phone calls, SMS, GPS coordinates, Whatsapp calls or messages. That is why this tactic can be used to spy on the Messenger chats of a loved one or a family member. 3. Use a Keylogger. The term “keylogger” refers to spy. Shop whatsapp monitoring software,【 TelegramChannel:Kunghac】facebook messenger spy,khufiya camera app,spy on android phone remotely free,snapchat spy. Facebook Messenger spy app tracks the text messages sent and received in Facebook Messenger on Android phone or tablet. If you're looking for a feature-rich Facebook Messenger spy app that can show you everything, this is your best bet. Search results for 'mspy instagram spy app,【 TelegramChannel:Kunghac】santa spy cam app,hidden tracking app on phone,facebook messenger spy app,f'. ultimate iPad spy App – iKeyMonitor owns over 30 features which can help you spy on your children's or your employees' iPad by capturing screenshots. How to Read & Monitor Facebook Messenger Chats on Android & iPhone via Xnspy Xnspy app can track nine different instant messaging and dating. Spy Facebook messages of any android Mobile for FREE with Facebook Tracking. Track Facebook, Whatsapp, WeChat, Instagram, SMS messages, Location and many. Spapp Monitoring is the most advanced tracking app for Android. Spapp Monitoring records all phone calls, SMS, GPS coordinates, Whatsapp calls or messages.

Not directly but the link could take you to a popup, crapware page that would install it, dunno about through messenger app tho. Facebook Messenger Spy App is the best monitoring program for spying on Facebook messages and chats. Facebook tracker application – how to spy on Messenger. spyware android,facebook messenger spy free,mspy ratings,guestspy,ikeymonitor how to use,mspy screen recorder,.ea85'. Home; Search. Now it's easy to see who they're chatting privately with on the popular social media messenger. In this video, we will discuss the top 5 Spy Apps. I've done the hard work for you. After testing and reviewing dozens of different spy apps. Mobile Phone Tracker - hidden tracking app that secretly records location, SMS, call audio, WhatsApp, Facebook, Viber, camera, internet activity. Read Facebook conversations, spy on Facebook messenger, get access to a person's profile as you own. Qustodio — Superior spying capabilities like location tracking, comprehensive reports, and call & SMS monitoring. Qustodio also offers user-friendly apps. While it's tempting to want to spy on your kid, your employee or your spouse using these spy apps, it's probably one of the riskiest things. Track every message of Facebook by TheWiSpy monitoring tool. Facebook spy app helps you in monitoring their messages, chats, and conversations remotely. In today's digital age, where privacy and security are more important than ever, the use of Facebook Messenger spy app has become. Monitor Facebook messenger conversations along with sender details and specific timings of the messages sent and received. Also view call details on Facebook. Search results for messenger spy app free TelegramChannel:Kunghac】spyic iphone,spy on employees computer,minspy,disguised voice recorder,mspy lite app,spy. The best Facebook spy apps let you see everything the other person is doing on the app — their Facebook Messenger messages, the content they're posting and. Facebook · Instagram · Amenities · Location; Home Rentals. Yearly Rentals · Short-Term Rentals · Welcome Pack · Contact · Home · Amenities · Location · Yearly. Facebook spy app for Android that tracks Facebook messages, WhatsApp, calls, SMS and GPS location. Facebook tracker to monitor chats and calls. Phone spy lets you see texts, photos, calls, website history, GPS & more. Compatible with Android, iOS, PC and Mac. Facebook. With Mobile Tracker Free you can monitor conversations from Facebook messaging. View all messages received and sent from different conversations. Discover the top Facebook Messenger spying apps to securely monitor and track conversations. Stay informed and ensure digital safety with. Free mobile tracker app provides variety of features at free of cost SMS, Call recording, GPS locations, Facebook tracking, Cell phone tracker.