developersjp.online

Overview

Chime Credit Builder Card Explained

WalletHub's Take: The Secured Chime® Credit Builder Visa® Credit Card is a good credit card for people with bad or limited credit who are in the market for. The Chime card is simply a secured credit card. You make a deposit to Chime and receive a credit card with a limit equal to the deposit. A. The Credit Builder has two balances: a positive balance, which is what you deposit onto the card, and a negative balance, which is what you. Building your credit history helps show lenders you're reliable. Expanding your Experian credit file could mean more card & loan offers. øResults will vary. The Chime Credit Builder Visa® Credit Card is our no annual fee, no interest, secured credit card that helps you build your credit. Chime was listed under prepaid cards, but it is not a prepaid card at all, but a secured credit card account with visa branding. I was afraid that when they see. The Chime Credit Builder2 card is a secured Visa credit card. It works just like a regular credit card in that you can use it to buy gas, groceries or household. Enjoy no annual fee View U.S. Bank Secured Visa Credit Card Terms and Conditions and credit-building benefits. · View your credit score · Choose your payment due. No minimum security deposit required - Money added to Credit Builder will be held in a secured account as collateral for your Credit Builder Visa card. WalletHub's Take: The Secured Chime® Credit Builder Visa® Credit Card is a good credit card for people with bad or limited credit who are in the market for. The Chime card is simply a secured credit card. You make a deposit to Chime and receive a credit card with a limit equal to the deposit. A. The Credit Builder has two balances: a positive balance, which is what you deposit onto the card, and a negative balance, which is what you. Building your credit history helps show lenders you're reliable. Expanding your Experian credit file could mean more card & loan offers. øResults will vary. The Chime Credit Builder Visa® Credit Card is our no annual fee, no interest, secured credit card that helps you build your credit. Chime was listed under prepaid cards, but it is not a prepaid card at all, but a secured credit card account with visa branding. I was afraid that when they see. The Chime Credit Builder2 card is a secured Visa credit card. It works just like a regular credit card in that you can use it to buy gas, groceries or household. Enjoy no annual fee View U.S. Bank Secured Visa Credit Card Terms and Conditions and credit-building benefits. · View your credit score · Choose your payment due. No minimum security deposit required - Money added to Credit Builder will be held in a secured account as collateral for your Credit Builder Visa card.

Whether you need to establish a credit history or rebuild your credit, Credit Builder Plus Membership helps you build credit while you save — with no hard. You can build credit with all the things you buy on the daily (wherever Visa is accepted). It's that easy. YOU'VE GOT CRED. Varo sends your credit activity to. Both the Self Card and the Chime Card report payments to the three main credit bureaus, so on-time payments can improve your credit score. ▶︎ Read more: Chime. With the Chime® Credit Builder Loan, you'll enjoy all the benefits of a credit card while actively improving your credit score. Plus, with. With the Chime Credit Builder Card, your Chime checking account is linked to the card, lowering your risk of exceeding your credit limit. Chime does not report. The Credit Builder has two balances: a positive balance, which is what you deposit onto the card, and a negative balance, which is what you. It's a secured credit building loan funded by one of Self's partners and—instead of going to you—it's held in an interest-bearing CD. To get a portion of those. See developersjp.online to learn more. ³ Money added to Credit Builder will be held in a secured account as collateral for your Credit Builder Visa card, which means you. Kikoff offers a revolving line of credit and reports your payments to Equifax and Experian. · Kikoff Credit Builder review · What is Kikoff? · How Kikoff works. Annual savings on car, mortgage, and credit card payments with a point credit score increase 4/5. Ava addresses four of. The money you move into the Credit Builder secured account is the amount you can spend on your card (no minimum deposit required**). Turn on Safer Credit. Note: The Chime Credit Builder Visa® Card is issued by Stride Bank, N.A., Member FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used everywhere. What is a credit builder credit card? A credit builder credit card is aimed at helping people who need to build up a credit history from scratch or get their. Atlas is a modern 0% APR credit card. Build credit, get cash back at + locations, complete fraud protection, and more! You must log in to pay your bill online with your credit or debit card. These payments are processed by BillMatrix, a separate company not affiliated with. Mobile banking done better. Build credit while you bank. No overdraft fees/hidden fees. Current is a fintech not a bank. Banking services provided by Choice. The credit builder account helps you improve your credit over time, with no annual fee or minimum security deposit. With a Chime checking account, you also have. The Chime card is simply a secured credit card. You make a deposit to Chime and receive a credit card with a limit equal to the deposit. A. I don't feel like chime is a great credit card. And I'll tell you why. Chime will just report on your credit report as a debt. It doesn't show your credit limit. *Credit Builder requires a connected external bank account, connected paycheck, or one-time direct deposit of at least $ into Spend account. Members with a.

5g Towers Harmful

I am a more than a concerned citizen of the severe health impacts of 5G towers. My husband and I moved to. Murwillumbah 3 years ago and live less than Hardly any research has been published on the biological or health effects of 5G. According to EMF-Portal, an archive that contains more than 43, Is Radiofrequency Energy Dangerous to my Health? For many years, there has been concern about health effects from RF energy related to cell phones, cell towers. 5G will be the worst of both worlds. Because 5G frequencies are subject to more obstructions and interference, they expect to need a 5G mini cell tower every 2. In general, research so far indicates that there is no increase in cancer risk associated with normal levels of mobile phone use. There is inconsistent evidence. New transmission towers are being built for the 5G network. However, the proximity to them and the electromagnetic fields is not dangerous. At this time, there's no strong evidence that exposure to RF waves from cell phone towers causes any noticeable health effects. no health risks have been established from exposure to the low-level radio signals used for mobile communications." 5G and Health. Electromagnetic fields and. It is important to note that 5G towers emit non-ionizing frequencies, which means they do not pose a health risk or cause illnesses like cancer. I am a more than a concerned citizen of the severe health impacts of 5G towers. My husband and I moved to. Murwillumbah 3 years ago and live less than Hardly any research has been published on the biological or health effects of 5G. According to EMF-Portal, an archive that contains more than 43, Is Radiofrequency Energy Dangerous to my Health? For many years, there has been concern about health effects from RF energy related to cell phones, cell towers. 5G will be the worst of both worlds. Because 5G frequencies are subject to more obstructions and interference, they expect to need a 5G mini cell tower every 2. In general, research so far indicates that there is no increase in cancer risk associated with normal levels of mobile phone use. There is inconsistent evidence. New transmission towers are being built for the 5G network. However, the proximity to them and the electromagnetic fields is not dangerous. At this time, there's no strong evidence that exposure to RF waves from cell phone towers causes any noticeable health effects. no health risks have been established from exposure to the low-level radio signals used for mobile communications." 5G and Health. Electromagnetic fields and. It is important to note that 5G towers emit non-ionizing frequencies, which means they do not pose a health risk or cause illnesses like cancer.

5G mobile technology promises a ten-fold increase in data transmission rates compared to current 4G networks, which will be achieved by using a higher. The infrastructure of 5G is different. Both 3G and 4G employ radio waves which are transferred from one large cell phone tower to another. Since microwave. When you use your cellphone, it connects to the network through a cellsite. Cellsites are also known as cellphone towers or base stations. The non-ionizing radiation used by commercial wireless 4G LTE and 5G devices have not been shown to cause cancer in humans. According to the American Cancer. Other studies link cell phone and cell tower radiation to memory loss, headaches, changes in vision and mood, sleep disorders and leukemia. The rollout of 5G. Is Radiofrequency Energy Dangerous to my Health? For many years, there has been concern about health effects from RF energy related to cell phones, cell towers. no health risks have been established from exposure to the low-level radio signals used for mobile communications." 5G and Health. Electromagnetic fields and. There are no scientifically proven adverse health impacts from the exposure to 5G radio frequency radiation with levels below those suggested by the guidelines. New 5G- Fifth Generation technology is also based on this faulty assumption of no biologic harm, despite growing scientific evidence showing broad harm on all. The higher frequencies used in 5G technology are known to be particularly damaging to towers in our fields and antennas along our railway lines. There is no evidence that electromagnetic fields from existing (2G, 3G and 4G) mobile networks pose any health risks. 5G means more utility and potential for IoT. As more devices are encouraged to connect, billions of devices with varied security means billions of possible. Learners will also discuss the implications of this research for 5G, the fifth generation of cellular technology. Learning Objectives. Identify common injuries. 5G mobile technology promises a ten-fold increase in data transmission rates compared to current 4G networks, which will be achieved by using a higher. New transmission towers are being built for the 5G network. However, the proximity to them and the electromagnetic fields is not dangerous. If they fall over, they can hurt you big time. Seriously: there are a lot of requirements concerning civil engineering in relation to towers. There is no convincing reason – either in theory or according to hard evidence – that 5G technology, by design, could present novel risks to any living. TOWERS AND 5G. TECHNOLOGY. Visit developersjp.online and search 5G Technology for studies establishes only 2 adverse health effects that can occur at levels. With the introduction of a new generation of mobile networks, questions are naturally being raised about health and safety aspects related to the RF EMF. The exposure can cause psychological effects to the cardiovascular system, nervous system, and overall immune system. Part 2: Is 5G harmful to the environment?

Ira Calculator

This calculator estimates the balances of Roth IRA savings and compares them with regular taxable account. It is mainly intended for use by US residents. Use the Roth IRA calculator to determine how much a Roth IRA account can save in your retirement plan. Use our Roth vs. Traditional IRA Calculator to see which retirement account is right for you and how much you can contribute annually. Roth IRA Calculator Creating a Roth IRA can make a big difference in your retirement savings. There is no tax deduction for contributions made to a Roth IRA. Free IRA calculator to estimate growth, tax savings, total return, and balance at retirement of Traditional, Roth IRA, SIMPLE, and SEP IRAs. Creating a Roth IRA can make a big difference in your retirement savings. There is no tax deduction for contributions made to a Roth IRA, however all future. Use this free Roth IRA calculator to estimate your account balance at retirement and determine how much you are eligible to contribute in Answer a few questions in the IRA Contribution Calculator to find out whether a Roth or traditional IRA might be right for you, based on how much you're. With our IRA calculators, you can determine potential tax implications, calculate IRA growth, and ultimately estimate how much you can save for retirement. This calculator estimates the balances of Roth IRA savings and compares them with regular taxable account. It is mainly intended for use by US residents. Use the Roth IRA calculator to determine how much a Roth IRA account can save in your retirement plan. Use our Roth vs. Traditional IRA Calculator to see which retirement account is right for you and how much you can contribute annually. Roth IRA Calculator Creating a Roth IRA can make a big difference in your retirement savings. There is no tax deduction for contributions made to a Roth IRA. Free IRA calculator to estimate growth, tax savings, total return, and balance at retirement of Traditional, Roth IRA, SIMPLE, and SEP IRAs. Creating a Roth IRA can make a big difference in your retirement savings. There is no tax deduction for contributions made to a Roth IRA, however all future. Use this free Roth IRA calculator to estimate your account balance at retirement and determine how much you are eligible to contribute in Answer a few questions in the IRA Contribution Calculator to find out whether a Roth or traditional IRA might be right for you, based on how much you're. With our IRA calculators, you can determine potential tax implications, calculate IRA growth, and ultimately estimate how much you can save for retirement.

KeyBank's Roth IRA Calculator shows you how a Roth IRA grows and compares it to savings options with taxable growth, so you can make an informed choice. Early Withdrawal Calculator for (k)s, (b)s or other retirement IRA owner. Consider any impacts resulting from the possibility of your plan. Exactly how — and how much — will contributing to a regular IRA help you in retirement? Use this handy calculator to find out. This calculator assumes that you make your contribution at the beginning of each year. For , the maximum annual IRA contribution is $7, which is a $ developersjp.online provides a FREE traditional IRA calculator and other (k) calculators to help consumers determine the best option for retirement savings. developersjp.online provides a FREE Roth IRA calculator and other k calculators to help consumers determine the best option for retirement savings. If you contribute $2, to a traditional IRA and qualify for the full $2, tax deduction, the value of your tax deduction is $2, X 30% or $ The after-. The Roth IRA Conversion Calculator is intended to serve as an educational tool and should not be the primary basis of your investment, financial, or tax. Annual contribution. The amount you will contribute to your Roth IRA each year. This calculator assumes that you make your contribution at the beginning of each. Traditional IRA Calculator. Contributing to a traditional IRA can create a current tax deduction, plus it provides for tax-deferred growth. While long term. Calculate your IRA contribution limits. When it comes to IRAs, your age, income and filing status all have a say in how much you can tuck away. Use our Roth IRA Calculator and find out how contributing makes a big difference in your retirement savings. This calculator assumes that your return is compounded annually and your contributions are made at the beginning of each year. The annual rate of return for your IRA. This calculator assumes that your return is compounded annually and your contributions are made at the beginning of each. How much can I contribute to an IRA? · In , you can contribute up to a maximum of $7, (Traditional IRA) or $7, (Roth IRA) · You are leaving Carter. Use our required minimum distribution (RMD) calculator to determine how much money you need to take out of your traditional IRA or (k) account this year. Roth IRA Calculator. Creating a Roth IRA can make a big difference in your retirement savings. There is no tax deduction for contributions made to a Roth IRA. Roth IRA Calculator. Creating a Roth IRA can make a big difference in your retirement savings. There is no tax deduction for contributions made to a Roth. If you contribute $2, to a traditional IRA and qualify for the full $2, tax deduction, the value of your tax deduction is $2, X 30% or $ The after-. The UCCU IRA Calculator can help you choose between a Traditional or Roth IRA. Learn how UCCU can help your retirement savings grow.

3 Apy Savings Account

From goal-oriented kids savings to HSAs and CDs, open an online savings account to reach your next savings milestone. % APY (Annual Percentage Yield)footnote 1. compounded daily, paid monthly. The best high-yield savings accounts offer % APY from BrioDirect High Yield Savings Account and % APY from Ivy Bank High-Yield Savings Account. *Disclosures: ANNUAL PERCENTAGE YIELD (APY): All APYs are accurate as of 8/25/ APYs are subject to change at any time. The best high-yield savings accounts offer % APY from BrioDirect High Yield Savings Account and % APY from Ivy Bank High-Yield Savings Account. Earn a high-yield savings rate. Make the easiest decision with a great savings rate. Savings Account Balance, Annual Percentage Yield (APY). Any balance, NaN. Calculate Annual Percentage Yield using our APY Interest Calculator. Learn how competitive interest rates can help your money grow faster. To receive a disclosed Relationship Interest Rate/Relationship APY, the eligible savings account 3. Subject to account eligibility requirements. 4. CNBC Select picked the 14 best high-yield savings accounts on the market, zeroing in on APY, fees and balance requirements. From goal-oriented kids savings to HSAs and CDs, open an online savings account to reach your next savings milestone. % APY (Annual Percentage Yield)footnote 1. compounded daily, paid monthly. The best high-yield savings accounts offer % APY from BrioDirect High Yield Savings Account and % APY from Ivy Bank High-Yield Savings Account. *Disclosures: ANNUAL PERCENTAGE YIELD (APY): All APYs are accurate as of 8/25/ APYs are subject to change at any time. The best high-yield savings accounts offer % APY from BrioDirect High Yield Savings Account and % APY from Ivy Bank High-Yield Savings Account. Earn a high-yield savings rate. Make the easiest decision with a great savings rate. Savings Account Balance, Annual Percentage Yield (APY). Any balance, NaN. Calculate Annual Percentage Yield using our APY Interest Calculator. Learn how competitive interest rates can help your money grow faster. To receive a disclosed Relationship Interest Rate/Relationship APY, the eligible savings account 3. Subject to account eligibility requirements. 4. CNBC Select picked the 14 best high-yield savings accounts on the market, zeroing in on APY, fees and balance requirements.

Unlike other types of high interest savings accounts, you can write checks from your money market savings account. With the Fifth Third Relationship Money. 3 4 5 developersjp.online Open an Account (opens new window) Interest Rate and APY of a Certificate of Deposit account is fixed once the account is funded. The best high-yield savings accounts have high APYs, low fees and are federally insured. APY, or annual percentage yield, is the yearly return on a bank or investment account. APY includes the effects of compounding interest. as of Sep 1. %. Best High-Yield Savings Account Rates for August · Poppy Bank – % APY · Flagstar Bank, Savings Plus – % APY · Western Alliance Bank – % APY. Calculate Annual Percentage Yield using our APY Interest Calculator. Learn how competitive interest rates can help your money grow faster. EARN % APY! Take advantage of our 6-month intro rate on Market Monitor accounts Get Details. APY: The main appeal of a high-yield savings account is the higher interest rate or APY. The higher the APY, the more your money will grow over time. Fees. % annual percentage yield (APY) is only available to customers who maintain at least $, on deposit in their account TD Signature Savings AND link an. Cash Bonus at the same time as your cash back redemption. For Truist One Checking account clients, we perform a calculation for each of the prior three (3). Earn up to % APY on all balances with a Secure Money Market account or UFB Secure account! See site for details. Use SmartAsset's free savings calculator to determine how your future savings will grow based on APY, initial deposit and periodic contributions. After the third month, your investment will earn interest on the $1, Savings or checking accounts may have either a variable APY or fixed APY. A. With the Western Alliance Bank High-Yield Savings Premier account, you can enjoy FDIC insurance and no fees3 while earning a much higher return on your money. Growth Savings % APY1. Grow your personal savings and save for a brighter tomorrow with a high-yield savings account. Open. When it comes to your savings goals, APY matters. But first, what is APY? APY, or annual percentage yield, is the real rate of return on money in a bank. Earn up to % APY when you deposit at least $25, into a new Elite Money Market Account or an existing account that was opened within the last 30 days. Advertised Online Savings Account APY is accurate as of 08/26/ Applies 3 yrs. $2, 4 yrs. $3, 5 yrs. Total interest earned. $3, Total. Annual Percentage Yield (APY) as of August 26, APY may change at any time before or after account is opened. Maximum balance limits apply. This calculator. Want to put more in savings? Search participating merchants and earn up to 10% cash back on everyday purchases. Learn more about BankAmeriDeals.

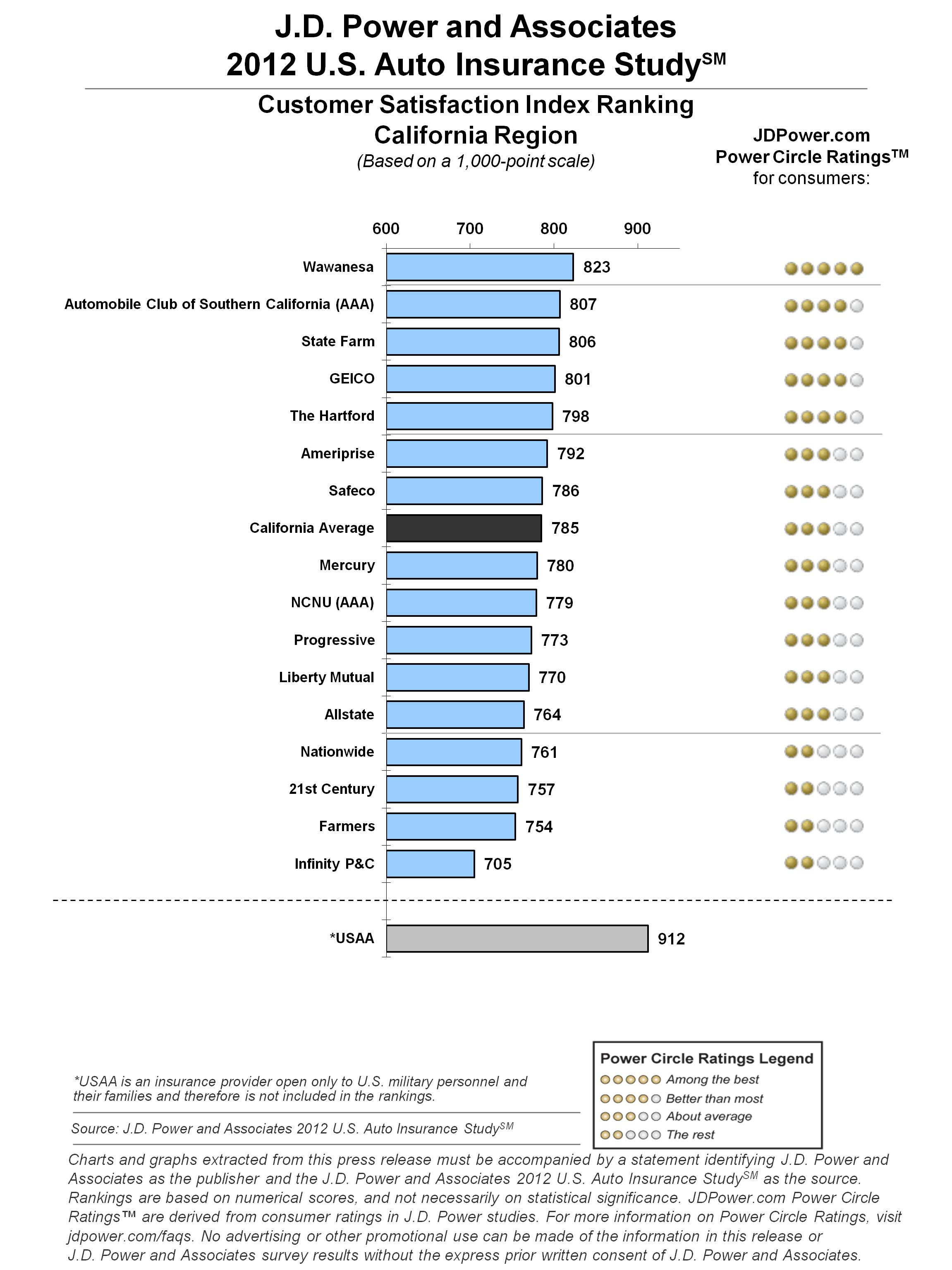

Car Insurance Customer Satisfaction

USAA tops our rating of the best car insurance companies, and is at or near the top in all of the subcategories we looked at. It was No. 1 for customer service. “The best customer service I have ever experienced when filing a claim. Speedy process from start to finish. Never been so satisfied with an insurance claim. Looking for the best car insurance? Consumer Reports has honest ratings and reviews on car insurance from the unbiased experts you can trust. Worst Car Insurance Company for Claims. We had to reach out to file a claim Lower rate for my vehicle than previous insurance. Customer service was. Leading global market research company JD Power has announced that Shelter Insurance ranked Highest in Customer Satisfaction among Auto Insurers in the Central. The insurance company with the highest customer satisfaction is Geico, according to WalletHub's analysis of factors such as J.D. Power customer satisfaction. Travelers and USAA also receive 5 stars in our analysis of the best car insurance companies, Erie, Geico and Progressive earn between 4 and stars and are. AAA is known for its world-renowned roadside assistance memberships, but is it a great choice for car insurance, too? Find out with our latest review. Learn. USAA tops our rating of the best car insurance companies, and is at or near the top in all of the subcategories we looked at. It was No. 1 for customer service. USAA tops our rating of the best car insurance companies, and is at or near the top in all of the subcategories we looked at. It was No. 1 for customer service. “The best customer service I have ever experienced when filing a claim. Speedy process from start to finish. Never been so satisfied with an insurance claim. Looking for the best car insurance? Consumer Reports has honest ratings and reviews on car insurance from the unbiased experts you can trust. Worst Car Insurance Company for Claims. We had to reach out to file a claim Lower rate for my vehicle than previous insurance. Customer service was. Leading global market research company JD Power has announced that Shelter Insurance ranked Highest in Customer Satisfaction among Auto Insurers in the Central. The insurance company with the highest customer satisfaction is Geico, according to WalletHub's analysis of factors such as J.D. Power customer satisfaction. Travelers and USAA also receive 5 stars in our analysis of the best car insurance companies, Erie, Geico and Progressive earn between 4 and stars and are. AAA is known for its world-renowned roadside assistance memberships, but is it a great choice for car insurance, too? Find out with our latest review. Learn. USAA tops our rating of the best car insurance companies, and is at or near the top in all of the subcategories we looked at. It was No. 1 for customer service.

Elephant is proud to report our score is 32% higher than the industry average for car insurance. We are proud that our efforts to serve our customers well is. Life insurance companies ranked in customer satisfaction were American General at percent, Jackson National at percent and Allstate at percent. AAA Car Insurance has earned a 94% satisfaction rate* from customers. We must be doing something right! card. Commitment. With AAA Car Insurance, you can enjoy. We reviewed the best car insurance companies. Our data-driven reviews help you find the best insurance for your vehicles. State Farm is the largest insurance company in the country and it offers many coverage options from auto and home insurance to renters and life insurance. As part of our P&C Customer Satisfaction Survey, more than consumers were asked about how the claims process influences customer satisfaction. We learned. Travelers and USAA also receive 5 stars in our analysis of the best car insurance companies, Erie, Geico and Progressive earn between 4 and stars and are. There are more than two hundred auto insurance companies to choose from. See how SmartFinancial ranks the best car insurance companies in the U.S. Key Takeaways · Progressive has a U.S. News rating of out of 5. · The company falls short in customer service, customer loyalty, and claims handling. Amica. Awards. Best auto insurance company overall (tie). Progressive insurance reviews. Read reviews of our auto insurance, homeowners insurance, and more. Easily find ratings and reviews for the insurance you're. Insurify uses an in-house, proprietary method to rate and review the best car insurance companies. The Insurify Quality (IQ) Score uses more than 15 crucial. As part of our P&C Customer Satisfaction Survey, more than consumers were asked about how the claims process influences customer satisfaction. We learned. Pure reviews · How does Pure compare to other top car insurance companies · Pure Details · Follow on. Great customer service and customer support. Followed up on my claim and took care of me and my car without a long delay. So I was back on the road in no time. State Farm has the cheapest car insurance for most drivers, including teens. It also offers the cheapest home insurance among nationwide companies. We give A-Max Auto Insurance stars out of overall. The company's low premiums and caring insurance agents make it a solid choice for finding car. Elephant insurance offers competitive rates directly to drivers, but has more complaints than the national average. GAINSCO Auto Insurance Review. GAINSCO auto. Different life events, budget and saving opportunities may be good reasons to review your auto insurance coverage. Learn why and how to do it.

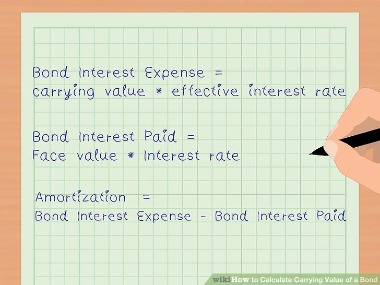

Face Value Of A Bond

Principal, also known as par value or face value in the bond market, is the amount of money the issuer will return to bondholders at maturity. Face or nominal value is set up when the company or the firm starts issuing its bonds and shares. In the case of stocks, this value is equal to the original. Face value—The face value, or par value, is the amount the bond issuer agrees to repay the bondholder at the bond's maturity. · Maturity date—The maturity date. But if you buy and sell bonds, you'll need to keep in mind that the price you'll pay or receive is no longer the face value of the bond. The bond's. Par value is the nominal or face value of a bond, share of stock, or coupon as indicated on a bond or stock certificate. Note that the present value of the bond is equal to the face value if the six-monthly coupon rate is equal to the six-monthly effective rate of interest. Such a. In the market, bond prices are quoted as a percent of the bond's face value. The easiest way to understand bond prices is to add a zero to the price quoted in. In this case, the “face value” of each bond is $1, The corporation – now referred to as the bond issuer − determines an annual interest rate, known as the. We've established above that the face value of a bond refers to the amount the issuer pays the investor once maturity has been reached. What about the face. Principal, also known as par value or face value in the bond market, is the amount of money the issuer will return to bondholders at maturity. Face or nominal value is set up when the company or the firm starts issuing its bonds and shares. In the case of stocks, this value is equal to the original. Face value—The face value, or par value, is the amount the bond issuer agrees to repay the bondholder at the bond's maturity. · Maturity date—The maturity date. But if you buy and sell bonds, you'll need to keep in mind that the price you'll pay or receive is no longer the face value of the bond. The bond's. Par value is the nominal or face value of a bond, share of stock, or coupon as indicated on a bond or stock certificate. Note that the present value of the bond is equal to the face value if the six-monthly coupon rate is equal to the six-monthly effective rate of interest. Such a. In the market, bond prices are quoted as a percent of the bond's face value. The easiest way to understand bond prices is to add a zero to the price quoted in. In this case, the “face value” of each bond is $1, The corporation – now referred to as the bond issuer − determines an annual interest rate, known as the. We've established above that the face value of a bond refers to the amount the issuer pays the investor once maturity has been reached. What about the face.

For bonds, the face value is the same thing as par value: the amount the bondholder will receive at maturity. For stocks, the face value refers to the. Bond valuation is the process by which an investor arrives at an estimate of the theoretical fair value, or intrinsic worth, of a bond. The value of the bond is the present value of its expected future cash flows. The cash flows consist of the regular interest or coupon payments and the face. Par value is % of that is Price of bond = present value if the cash flows. Cash flows consist of coupon payments. Last cash flow. The price for a bond or a note may be the face value (also called par value) or may be more or less than the face value. The price depends on the yield to. The market value of a bond, on the other hand, is the price at which investors likely will buy or sell the bond in the secondary market prior to maturity, which. Bond prices are determined by 5 factors: Generally, the issuer sets the price and the yield of the bond so that it will sell enough bonds to supply the amount. Face value, also known as par value, is a trading term used to describe the nominal value of a security. For bonds this is the amount that the bondholder. A bond with a face value of $ and a market price of 94 would cost an investor $ (not including accrued interest). When a bond is purchased for the full. The YTMis the single discount rate for which the present value of all the bond's future cash flows equals the bond's market price. Equivalently, we can define. The bond valuation formula can be represented as: Price = (Coupon × 1 − (1 + r) − n r) + Par Value (1 + r) n. The bond value formula can be broken into. The face value, sometimes called nominal value, is the value of a coin, bond, stamp or paper money as printed on the coin, stamp or bill itself by the. The face value of a bond payable is the amount printed on the bond. When a company issues a bond, it's generally priced at what is known as par value, usually $ After a bond is issued, it can be traded. As interest rates. Note that the present value of the bond is equal to the face value if the six-monthly coupon rate is equal to the six-monthly effective rate of interest. Such a. These types of bonds are redeemable at premium (i.e. value greater than the face value of the bond).The redemption value is stated as a percentage of face value. For example, if you buy a $1, bond at par (often described as “trading at ,” meaning percent of its face value) and receive $45 in annual interest. (Note: This is how bond prices are generally quoted – as a percentage of the face (par) value – indicating investors are willing to pay 97%, 95% or % of the. The amount a bond sells for below face value is a discount. A difference between face value and issue price exists whenever the market rate of interest for. Bond valuation involves calculating the present value of the bond's future coupon payments, its cash flow, and the bond's value at maturity (or par value), to.

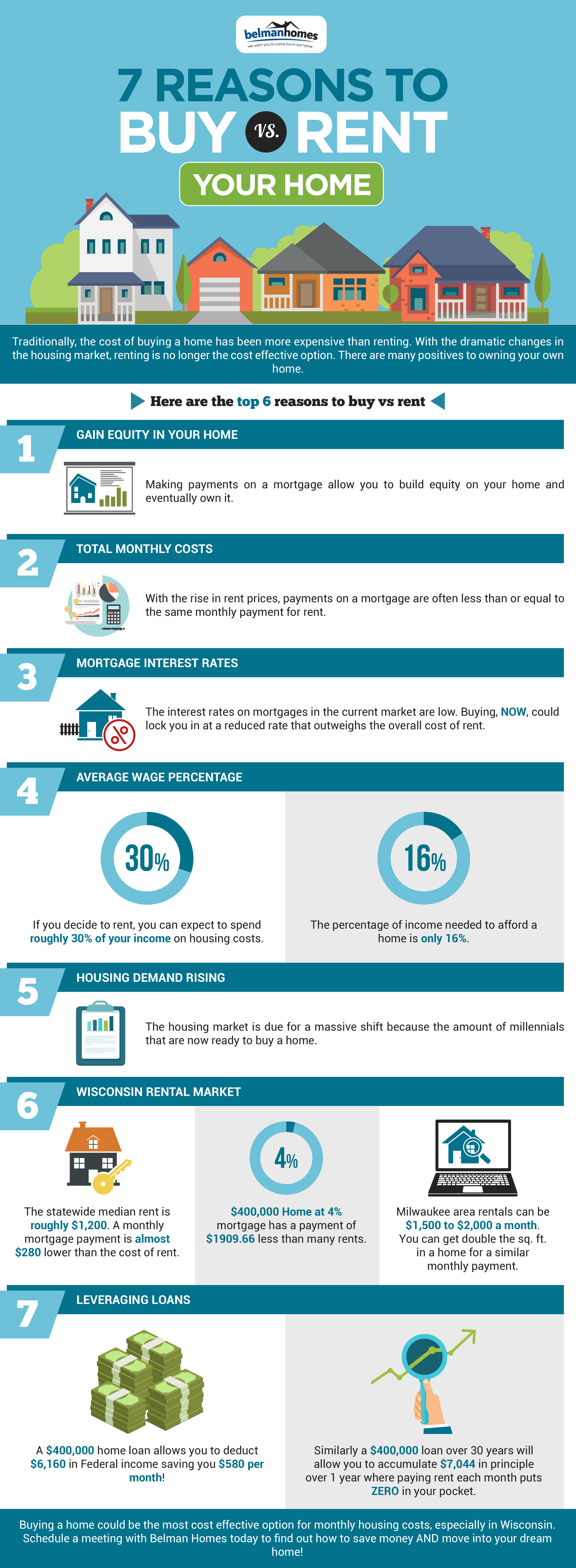

Is It Cheaper To Own A House Or Rent

The cost of renting is generally less expensive than buying the same quality of home Rent is less expensive than a mortgage on a monthly basis in most places. Renting can be cheaper than owning a home, though that can depend upon housing market conditions in a given area and the particulars of the home in question. In. Buying a home is not a decision to take lightly. Generally speaking it costs more to own a home, at least in the short term, than to rent. That's why potential. And everyone knows assumes that buying is more cost-effective than renting — as long as you're paying down the principal on your mortgage, you're going to come. Buying a home is not a decision to take lightly. Generally speaking it costs more to own a home, at least in the short term, than to rent. That's why potential. It can be cheaper to buy than rent. The upfront cost of a home may be daunting, but over time you could save yourself a lot of money. Mortgage repayments are. In general, owning a home can be cheaper than renting over the long term. This is because homeowners are building equity in the home, which can help them build. Depending on where you live, it could be more expensive to buy a house than rent or vice versa. Whether you rent or buy, at some point, someone will steal your. The short answer is, yes, in the long run home ownership is usually a better financial option. Even if a bit more expensive than rent initially. The cost of renting is generally less expensive than buying the same quality of home Rent is less expensive than a mortgage on a monthly basis in most places. Renting can be cheaper than owning a home, though that can depend upon housing market conditions in a given area and the particulars of the home in question. In. Buying a home is not a decision to take lightly. Generally speaking it costs more to own a home, at least in the short term, than to rent. That's why potential. And everyone knows assumes that buying is more cost-effective than renting — as long as you're paying down the principal on your mortgage, you're going to come. Buying a home is not a decision to take lightly. Generally speaking it costs more to own a home, at least in the short term, than to rent. That's why potential. It can be cheaper to buy than rent. The upfront cost of a home may be daunting, but over time you could save yourself a lot of money. Mortgage repayments are. In general, owning a home can be cheaper than renting over the long term. This is because homeowners are building equity in the home, which can help them build. Depending on where you live, it could be more expensive to buy a house than rent or vice versa. Whether you rent or buy, at some point, someone will steal your. The short answer is, yes, in the long run home ownership is usually a better financial option. Even if a bit more expensive than rent initially.

When it comes to your finances, the main difference between renting and buying a home is that when you rent, you're paying someone else's mortgage while when. Home Rent vs Buy Calculator How much does it cost to buy versus to rent? Use this calculator to compare the cost of buying and renting over the coming years. Comparing apples to apples, yes, speaking generally owning a home is almost always more cost effective than renting. However, you can rent a. The overall cost of homeownership tends to be higher than renting even if your mortgage payment is lower than the rent. Here are some expenses you'll be. The overall cost of homeownership tends to be higher than renting even if your mortgage payment is lower than the rent. Here are some expenses you'll be. Cheaper - Generally, rent payments tend to be lower than mortgage payments and may cover other costs, such as utilities, hydro, cable and internet. Flexibility. Homeowners and investors get the best deal in West Virginia, where a mortgage payment and property taxes is about half as costly as renting. Buying is cheaper if you stay for years or longer. Otherwise, renting is cheaper. Year Average Monthly Cost $3K $4K $5. Buying and Renting: Why Buying a Home Can be Cheaper than Renting Believe it or not, there's a strong chance that owning a home could actually lighten your. Even more recently, ATTOM released their Rental Affordability Report, which found that owning a median-priced home was more affordable than the average. You will save $,, an average of $19, per month. If you stay in your home for 1 years, renting is the cheaper option. Buying average net cost. It's an age-old question that confronts most Americans at some point: is it better to rent or buy a home? While the conventional wisdom is that buying a. Divide the purchase price of a similar property by that annual rent number. A ratio greater than 20 generally weighs in favor of renting, while a figure less. In general, owning a home can be cheaper than renting over the long term. This is because homeowners are building equity in the home, which can help them build. When you buy a home, your mortgage payment is locked in for the length of the loan — unlike rent. Your monthly rent payment is likely to increase at each lease. Buying is cheaper if you stay for years or longer. Otherwise, renting is cheaper. Year Average Monthly Cost $3K $4K $5. Buying a house can be a long-term investment and a chance to make a place truly your own. · Renting your home can protect you against repair costs and downturns. One of the most common arguments in favour of buying is that mortgage payments are often cheaper than rent payments. This is especially true in Japan, where. Cheaper than a mortgage (on average) · Potential to split rent with roommates · Easier to find housing near transit/work · Rise in available rental units due to. If you don't plan on living in the home for a long time, then it might make better sense to rent. When you buy a home, you have to costs that you incur and you.

How Much Is It To Go Bankrupt

The going rate seems to be about $1, in Riverside and San Bernardino, $1, in Los Angeles, Orange County and San Diego. The price has very. How much money can I borrow in federal student loans? What will I need to Go to the Student Loan Repayment page. Help me find a page on the site. My. On average, filing bankruptcy costs between $1, and $4, in court filing fees and attorney fees. Learn more about the cost to file bankruptcy and how to. Many high income bankruptcy filers worry they make too much to file for bankruptcy Please enter a valid Case Description. Description is required. How much does bankruptcy cost? · $ filing fee (Chapter 7) $ filing fee (Chapter 13) · Around $$20 for online pre-bankruptcy course · Around $$20 for. As of December , if you file for Chapter 7 bankruptcy (the most common form of bankruptcy for individuals) you will pay $ Court filing fee to declare. Depending on the complexity of your case, there may be court fees, legal fees and other expenses totaling a few hundred to a few thousand dollars. At Jeff Field. Step 1: make sure bankruptcy is the right option for you · Step 2: complete the bankruptcy form and pay the fee · Step 3: withdraw some money for your living. For filing a petition under Chapter 7, 12, or 13, $ · For filing a petition under Chapter 9, 11, or 15, $ · When a motion to divide a joint case under. The going rate seems to be about $1, in Riverside and San Bernardino, $1, in Los Angeles, Orange County and San Diego. The price has very. How much money can I borrow in federal student loans? What will I need to Go to the Student Loan Repayment page. Help me find a page on the site. My. On average, filing bankruptcy costs between $1, and $4, in court filing fees and attorney fees. Learn more about the cost to file bankruptcy and how to. Many high income bankruptcy filers worry they make too much to file for bankruptcy Please enter a valid Case Description. Description is required. How much does bankruptcy cost? · $ filing fee (Chapter 7) $ filing fee (Chapter 13) · Around $$20 for online pre-bankruptcy course · Around $$20 for. As of December , if you file for Chapter 7 bankruptcy (the most common form of bankruptcy for individuals) you will pay $ Court filing fee to declare. Depending on the complexity of your case, there may be court fees, legal fees and other expenses totaling a few hundred to a few thousand dollars. At Jeff Field. Step 1: make sure bankruptcy is the right option for you · Step 2: complete the bankruptcy form and pay the fee · Step 3: withdraw some money for your living. For filing a petition under Chapter 7, 12, or 13, $ · For filing a petition under Chapter 9, 11, or 15, $ · When a motion to divide a joint case under.

Bankruptcy is a legal proceeding initiated when a person or business cannot repay outstanding debts or obligations. It offers a fresh start for people who. In most bankruptcies the direct cost to the person filing bankruptcy is $2, Usually the Licensed Insolvency Trustee will work out a payment plan where you. You are required to make a minimum monthly contribution of $ per month while bankruptcy but this cost can increase if you have surplus income or assets. How Much Does it Cost to File Bankruptcy Without A Lawyer? · Chapter 7 Bankruptcy Filing Fee = $ · Chapter 13 Bankruptcy Filing Fee = $ The filing fee to the Bankruptcy Court for a Chapter 13 petition is $ Therefore, the cost to file a Chapter 13 case is about $ plus the attorney fees. The law firm's services for a Chapter 7 filing start at $ (plus court costs), and this fee must be paid before any filing as it is a violation of the. When do bankruptcy costs need to be paid? Bankruptcy fees, £ in England or Wales and £ in Northern Ireland, must be paid up front – the application will. How can I find out about my refund when I'm in bankruptcy? Call with your bankruptcy case number and ask to be referred to a bankruptcy specialist. When you file for Chapter 13 bankruptcy, you must propose a repayment plan that details how you are going to pay back your debts over the next three to five. The going rate seems to be about $1, in Riverside and San Bernardino, $1, in Los Angeles, Orange County and San Diego. The price has very. How to go bankrupt yourself. If you wish to make yourself bankrupt, you must apply online. There is no minimum amount of debt you have to owe before you can. Although there is no minimum debt to file bankruptcy, we can help review your case and give you the best advice on which chapter of bankruptcy would most. All of your information must be prepared on forms that have been approved by the court. You must file the forms with the United States Bankruptcy Court, along. Deciding to file for bankruptcy is a big decision. It can affect you for a Enter your email. We'll only use this email to send this link. Enter your. How Much Does Chapter 7 Bankruptcy Cost? · $ filing fee, the cost for the court to handle your paperwork and case after you take it to the bankruptcy court. Bankruptcy does not relieve a debtor of the obligation to file all required tax returns and pay taxes that become due during the bankruptcy case. Failure to. How much does it cost to file for bankruptcy? As of December , it costs $ for court fees to file for bankruptcy under Chapter 7 and $ to file for. About Bankruptcy Filing bankruptcy can help a person by discarding debt or making a plan to repay debts. A bankruptcy case normally begins when the debtor. There is no fee to apply for bankruptcy. If you're currently in a debt agreement and want to apply for bankruptcy, contact your administrator. You must.

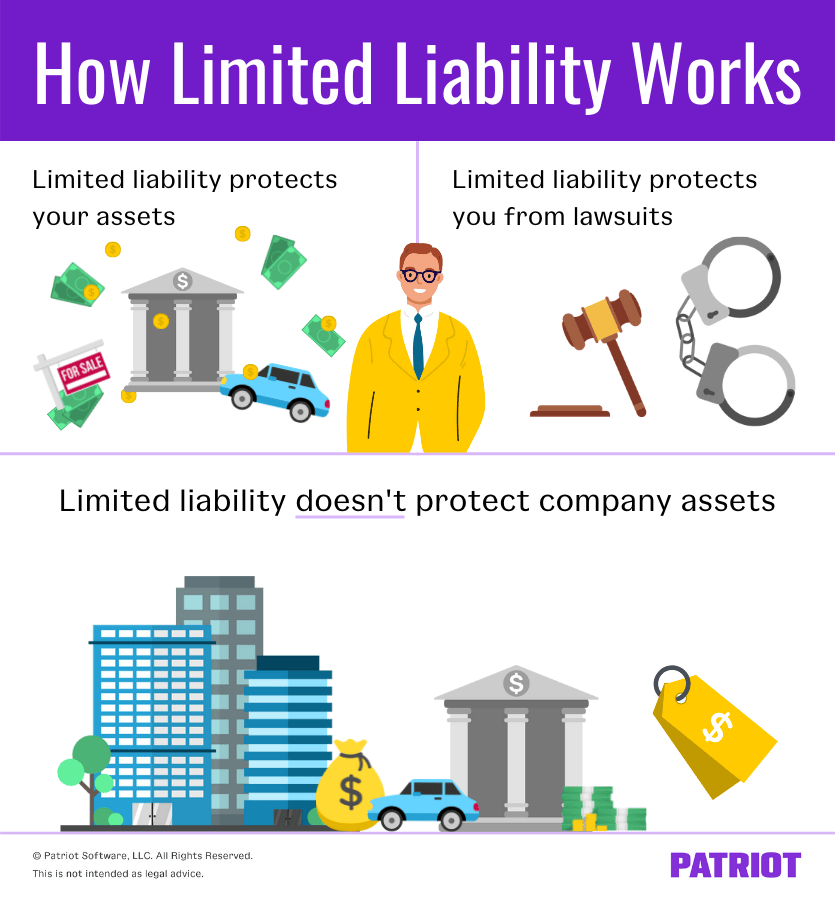

Limited By Liability

A limited liability company shields its members in essentially the same way as a corporation shields its shareholders. It is the legal protection available to the shareholders of privately- and publicly-owned companies, under which the financial liability of each shareholder. Limited liability is a legal status in which a person's financial liability is limited to a fixed sum, most commonly the value of a person's investment in a. The company agreement of a limited liability company governs: (1) the relations among members, managers, and officers of the company, assignees of membership. A limited liability company is formed at the time of filing of the certificate of organization with the Corporations Division. Limited Liability Company. Like a corporation, the limited liability company (LLC) limits the liability of its owners (called members) to the extent of their. A Limited Liability Company (LLC) is a business structure allowed by state statute. Each state may use different regulations, you should check with your. Limited liability is a way to make sure that a person who is engaging in business does not risk his or her personal possessions in case the business fails. A limited liability entity is any entity, other than a corporation, through which business may be conducted while offering limited liability to the owners. A limited liability company shields its members in essentially the same way as a corporation shields its shareholders. It is the legal protection available to the shareholders of privately- and publicly-owned companies, under which the financial liability of each shareholder. Limited liability is a legal status in which a person's financial liability is limited to a fixed sum, most commonly the value of a person's investment in a. The company agreement of a limited liability company governs: (1) the relations among members, managers, and officers of the company, assignees of membership. A limited liability company is formed at the time of filing of the certificate of organization with the Corporations Division. Limited Liability Company. Like a corporation, the limited liability company (LLC) limits the liability of its owners (called members) to the extent of their. A Limited Liability Company (LLC) is a business structure allowed by state statute. Each state may use different regulations, you should check with your. Limited liability is a way to make sure that a person who is engaging in business does not risk his or her personal possessions in case the business fails. A limited liability entity is any entity, other than a corporation, through which business may be conducted while offering limited liability to the owners.

The Partnerships Act permits certain professionals to practice in limited liability partnerships, provided that the following conditions are satisfied. A limited liability company (LLC) is a business structure for private companies in the United States, one that combines aspects of partnerships and. A limited liability company (LLC) is a type of business structure in which the owners of a business have limited liability. This means that the owners are not. What is a limited liability company (LLC)?. A limited liability company (LLC) is a business structure in the United States that provides its owners with limited. Limited liability is a kind of legal protection whereby owners and shareholders have no personal responsibility for their company's debts and financial. Secretary of State authorized to adopt certain regulations to allow limited-liability company to carry out powers and duties through most recent technology. The online process is quick and easy and the business entity will be registered within 24 hours. If you wish to register your Limited Liability Partnership by. Limited Liability is a legal structure whereby shareholders or directors are legally responsible for their company's debts only up to the value of their shares. A limited liability company (LLC) is a business structure for private companies in the United States, one that combines aspects of partnerships and. An LLC offers the personal liability protections of a corporation, meaning the personal assets of members are insulated from claims against the company in most. Limited liability, condition under which the losses that owners (shareholders) of a business firm may incur are limited to the amount of capital invested by. A limited liability company (LLC) limits the potential for its members to be personally liable for the LLC's business debts. It features pass-through. A limited liability company, or LLC, is a form of private company. Learn more about the definition of an LLC. A limited liability company (LLC) is a business structure that offers limited liability protection and pass-through taxation. Limited liability partnerships need to register with Registry of Joint Stock Companies to operate in Nova Scotia. The liability of partners in a limited. It is a business structure that can combine the pass-through taxation of a partnership or sole proprietorship with the limited liability of a corporation. An. A limited liability company can be managed by managers or by its members. The management structure must be stated in the certificate of formation. Management. Limited liability is a legal status which means that a person's financial liability is limited to a specific amount, usually the value of their investment in. Limited liability is a legal status which means that a person's financial liability is limited to a specific amount, usually the value of their investment in. Limited liability companies and corporations are types of legal business structures—ways to legally organize a business under state law.

How Do I Transfer Money

Step 1: Identify which accounts you'd like to transfer. All of your assets will move “in kind,” meaning there's no buying or selling. What's the fastest way to transfer money between banks? · Zelle is available either online or through its mobile app. · PayPal is another popular option. Bring a photo ID. You'll need a driver's license or other government ID. Choose how to pay. U.S. currency or a PIN-based debit card is accepted. Send and receive money with Zelle® · It's fast: Money is typically available in minutes. · It's easy: Log in to the Regions Mobile app or Online Banking and. Join over 10 million people who choose Wise for fast and secure online money transfers. Save up to 3x when sending money abroad. Transfer in 1 to 3 business days to a bank account · Go to your card info: On iPhone: Open the Wallet app, tap your Apple Cash card, tap the More button · Enter. How do I send money using PayPal? · Go to Send. · Enter your recipient's name, PayPal username, email, or mobile number. · Enter the amount, choose the currency. Pay for your online money transfer securely. Send money instantly with a debit card with a debit card or credit card2, or with your bank account. To send a wire transfer, log in to our Mobile app or Online Banking and tap Pay & Transfer. You will need your debit card number, PIN, and US mobile number OR. Step 1: Identify which accounts you'd like to transfer. All of your assets will move “in kind,” meaning there's no buying or selling. What's the fastest way to transfer money between banks? · Zelle is available either online or through its mobile app. · PayPal is another popular option. Bring a photo ID. You'll need a driver's license or other government ID. Choose how to pay. U.S. currency or a PIN-based debit card is accepted. Send and receive money with Zelle® · It's fast: Money is typically available in minutes. · It's easy: Log in to the Regions Mobile app or Online Banking and. Join over 10 million people who choose Wise for fast and secure online money transfers. Save up to 3x when sending money abroad. Transfer in 1 to 3 business days to a bank account · Go to your card info: On iPhone: Open the Wallet app, tap your Apple Cash card, tap the More button · Enter. How do I send money using PayPal? · Go to Send. · Enter your recipient's name, PayPal username, email, or mobile number. · Enter the amount, choose the currency. Pay for your online money transfer securely. Send money instantly with a debit card with a debit card or credit card2, or with your bank account. To send a wire transfer, log in to our Mobile app or Online Banking and tap Pay & Transfer. You will need your debit card number, PIN, and US mobile number OR.

Consumers have many options to move their money from one bank to another – these are usually free and do not take more than a couple of business days. Join over 10 million people who choose Wise for fast and secure online money transfers. Save up to 2x when sending money abroad. Transfer money · Sign in to developersjp.online · Select "Pay & transfer" · Select “Transfer money” · Read and agree to the terms and conditions, if prompted. However, an authorized committee may not transfer funds to another authorized committee of the same candidate if the transferring committee has net debts. Learn how to transfer money to another bank account · Create your profile · Choose where and how much · Enter who will get the money · Pick your payment option. Transfer money online anytime, anywhere between Atlantic Union Bank and non-Atlantic Union Bank accounts, and even pay friends. Learn more about how to move. Transfer in 1 to 3 business days to a bank account · On iPhone: Open the Wallet app, tap your Apple Cash card, tap the More button the more button, then tap. Transfer to or from Fidelity · Send money from my bankLog In Required · Send money to my bankLog In Required · Transfer between Fidelity accountsLog In Required. Move money or setup a future transfer within the Mobile Banking app or Online Banking. Transfers can be set up between your Bank of America accounts. Scotia International Money Transfer is a service that allows our Canadian retail customers to send international money transfers directly to a recipient's bank. Move money or setup a future transfer within the Mobile Banking app or Online Banking. Transfers can be set up between your Bank of America accounts. You can transfer money between your Wells Fargo checking and savings accounts and accounts you may have at other US financial institutions. A bank teller can help you set up many other transfer services, including wire transfers to another bank, state, or country. Transfer money out of the Google Wallet website You can transfer money from Google Pay to a bank account. Go to developersjp.online A bank transfer lets you move money from one bank account to another. It's usually instant, free and done using mobile or online banking, over the phone or in. A bank transfer lets you move money from one bank account to another. It's usually instant, free and done using mobile or online banking, over the phone or in. You can transfer any amount from one Desjardins account to another. Limit: none Available: on AccèsD, at an ATM, at a caisse or branch or by phone at Move money between your USAA Federal Savings Bank and non-USAA accounts. We can help you find an option for sending money that meets your needs. Sign up to transfer money online today ; Quick and easy sign up. It's easy to start sending money online and in person today. ; Pay the way that works for you. Find the wire transfer section on your online banking service · Enter the recipient's bank details · Enter the amount and currency you want to send · Pay the.