developersjp.online

Prices

Strong Biotin

Biotin plays a vital role in reinforcing and maintaining hair roots to prevent hair loss. It also strengthens nails and hair and helps keep skin strong and. Discover the best biotin supplements at Sephora! Shop biotin supplements now, and pay later in 4 interest-free payments with Klarna! Natrol Biotin supports healthy hair, skin & nails for those low in biotin. It also supports healthy carbohydrate, fat and protein metabolism. 10, MCG BIOTIN · supports full, shiny and strong hair · VEGAN SILK EXTRACT · vegan protein derived from fermentation biotechnology that supports hair strength. Unlike other vitamin deficiencies, there isn't a reliable lab test for detecting low biotin levels, so it's best identified through symptoms. These symptoms. Best Biotin Supplement in India. Biotin Benefits. BIOTIN FACILITATES HAIR & SKIN GROWTH: This max strength formula of mcg Biotin can help people who. These Extra Strength Biotin gummies support hair, skin and nails as well as help in fat, protein & carbohydrate metabolism. Boost hair strength and thickness with Garnier Fructis Grow Strong Shampoo for all hair types. Promotes hair and nail strength and growth. Biotin supports the production of keratin, the structural protein that lends strength to hair, skin, and nails. Biotin plays a vital role in reinforcing and maintaining hair roots to prevent hair loss. It also strengthens nails and hair and helps keep skin strong and. Discover the best biotin supplements at Sephora! Shop biotin supplements now, and pay later in 4 interest-free payments with Klarna! Natrol Biotin supports healthy hair, skin & nails for those low in biotin. It also supports healthy carbohydrate, fat and protein metabolism. 10, MCG BIOTIN · supports full, shiny and strong hair · VEGAN SILK EXTRACT · vegan protein derived from fermentation biotechnology that supports hair strength. Unlike other vitamin deficiencies, there isn't a reliable lab test for detecting low biotin levels, so it's best identified through symptoms. These symptoms. Best Biotin Supplement in India. Biotin Benefits. BIOTIN FACILITATES HAIR & SKIN GROWTH: This max strength formula of mcg Biotin can help people who. These Extra Strength Biotin gummies support hair, skin and nails as well as help in fat, protein & carbohydrate metabolism. Boost hair strength and thickness with Garnier Fructis Grow Strong Shampoo for all hair types. Promotes hair and nail strength and growth. Biotin supports the production of keratin, the structural protein that lends strength to hair, skin, and nails.

A high concentration of biotin in samples may compromise diagnostic tests in which biotin Best practices in mitigating the risk of biotin interference with. Pavo BiotinForte is the complete biotin supplement for horses with brittle hooves. ✓Strong, elastic hooves ✓Optimal horn quality ✓Shiny coat. We have the best Biotin supplement on the market today. Our selection of Biotin supplements will help with your beauty care regiment. Buy online now! Biotin gummies in a super yummy cherry flavor take the guesswork out of achieving healthy and strong Bueno hair, skin, and nails! Default Title. Purchase. Longer, stronger nails. Biotin hardens, thickens. Vitamin E ends cracks. Vitamin C stops splits. Hyaluronic acid hydrates. Grows longer. The Nature Made® Maximum Strength Biotin mcg Softgels, 50 Count for Supporting Healthy Hair, Skin and Nails† is a great vitamin supplement! It really helps. BIOTIN STRONG Hair and Nail contains biotin, sulphur-containing amino acid methione and zinc. Thin hair and brittle nails? Many women know thin hair and. Strong nails? Check. Glowing skin? Check. Keep on strutting your stuff with The Vitamin Shoppe® brand Biotin. Biotin is well-known for its ability to. The Best Supplements for Glowing Skin Healthy Hair and Strong Nails Doctor's Best, Biotin. The hair-vitamin biotin (vitamin H) and the natural vitamin B content are responsible for: healthy skin, strong, shiny coat, optimal pigmentation of coat. tablets per bottle, biotin mcg, biotin 10mg; Biotin ( Biotin tablets,10, mcg, for hair growth, skin, strong nails, biotin 10mg. Extra Strong Biotin Biotin is a water soluble vitamin required for normal growth and body function. Biotin functions as a key regulatory element in. Description• Science-Based Nutrition™ • Supports Hair, Skin, & Nails*• Non-GMO • Gluten Free • Soy Free • Vegan At Doctor's Best, we are all about pampering. Pure Biotin mcg Hair Growth, Strong Nails, Healthy Skin, Vitamin B7. Biotin mcg supports healthy hair, skin, and nails. World's first clinically studied vegan hair growth gummies for women supports longer, stronger hair with ingredients like biotin, zinc, and fo ti. Biotin plays a vital role in reinforcing and maintaining hair roots to prevent hair loss. It also strengthens nails and hair and helps keep skin strong and. biotin and are not experiencing deficiency. Your healthcare provider can help you decide the best course of action if you are looking to improve the health. Health Veda Organics Biotin 30mcg Supplement works wonders for your hair & skin. These tablets are loaded with natural Sesbania Extract to help revive your. Get up to 72HR fuller & thicker looking hair with Garnier Fructis Grow Strong Thickening Shampoo, formulated with Biotin & Vitamin C + Blood Orange Extract.

How Much Do You Need To Start Roth Ira

How much can I contribute? (updated July 29, ) · For , $6,, or $7, if you're age 50 or older by the end of the year; or your taxable compensation. Income: To contribute to a Roth IRA, you must have compensation (i.e. wages, salary, tips, professional fees, bonuses). Your modified adjusted gross income. A Roth can be opened with no money. The investments you make within the Roth may have minimums. A common one is $ for a popular mutual fund. You will also need to provide a government-issued proof of identification. A representative with the financial institution you choose will make sure you meet. If you're under 50 years of age, the maximum annual contribution limit is $7,0(limits do change annually). Those age 50 or older can contribute up. You can open an IRA at financial institutions, such as banks, brokerage firms and even mutual fund companies. While some IRAs have no minimum deposits, others. As far as amounts, in your 20s you should probably aim for at least 10% of your monthly income for retirement. If you are in under 15% tax bracket, strongly consider contributing to Roth (post tax money). It's about 5k max. Otherwise work towards maxing. Anyone can open a Roth IRA, including children and those who work part time. Learn more about opening a Roth IRA and how much you can contribute. How much can I contribute? (updated July 29, ) · For , $6,, or $7, if you're age 50 or older by the end of the year; or your taxable compensation. Income: To contribute to a Roth IRA, you must have compensation (i.e. wages, salary, tips, professional fees, bonuses). Your modified adjusted gross income. A Roth can be opened with no money. The investments you make within the Roth may have minimums. A common one is $ for a popular mutual fund. You will also need to provide a government-issued proof of identification. A representative with the financial institution you choose will make sure you meet. If you're under 50 years of age, the maximum annual contribution limit is $7,0(limits do change annually). Those age 50 or older can contribute up. You can open an IRA at financial institutions, such as banks, brokerage firms and even mutual fund companies. While some IRAs have no minimum deposits, others. As far as amounts, in your 20s you should probably aim for at least 10% of your monthly income for retirement. If you are in under 15% tax bracket, strongly consider contributing to Roth (post tax money). It's about 5k max. Otherwise work towards maxing. Anyone can open a Roth IRA, including children and those who work part time. Learn more about opening a Roth IRA and how much you can contribute.

Your Merrill Edge Self-Directed Roth IRA has unlimited $0 online stock, ETF and option trades with no trade or balance minimums. Options contract and other fees. Work with a J.P. Morgan advisor virtually or in your Chase branch to build a personalized financial strategy based on what's important to you, starting with. If you're under age 50, you can contribute up to $7, per year. · If you're 50 or older, you can contribute up to $8, per year. · If your earned income for. If you haven't yet opened this gift from Uncle Sam, do it now. You have until your tax return deadline to set up and make contributions for the previous tax. The minimum amount to open a Roth IRA varies depending on the financial institution. But many, particularly online brokers, don't require a minimum amount of. How much can you put in a Roth IRA? Let's take a look at the details of Roth IRA contribution limits. If you're under the age of 50 and meet specific income. Roth IRA accounts are a special type of investment that allow your earnings to grow tax-free. In your Roth IRA account, you can invest up to $6, per year for. If you are in under 15% tax bracket, strongly consider contributing to Roth (post tax money). It's about 5k max. Otherwise work towards maxing. In retirement you may need as much as % of your current after-tax income (take-home pay) minus any amount you are saving for retirement each year. This. A Roth IRA lets you take tax-free withdrawals from qualified distributions. It may be a good option if you're in a lower tax bracket. Investments personalized for you · No minimum to open an account—invest with as little as $10 · $0 advisory fee for balances under $25K (% for balances of $ What's your starting balance? How old are you? How much will you contribute annually? What age do you want to retire at? What's your expected rate of. You can put money in your account for as many years as you want, as long as you have earned income that qualifies. No employer-plan restrictions. It doesn't. Roth IRAs are subject to certain income limits. For instance, if you are married filing jointly or you're a qualified widow and your modified adjusted gross. If you file taxes as a single person, your Modified Adjusted Gross Income (MAGI) must be under $, for tax year and $, for tax year to. What's your starting balance? How old are you? How much will you contribute annually? What age do you want to retire at? What's your expected rate of. Contributions are not tax deductible · Eligibility is based on how much you earn · Never pay taxes on qualified withdrawals if you're at least age 59½ and made. No required minimum distributions (RMDs): Unlike traditional IRAs, Roth IRAs do not have RMDs, allowing your assets more time to grow tax free. Tax-free asset. To contribute to this type of retirement account, you will need to have a Modified Adjusted Gross Income (MAGI) that meets the income requirements. This will. However, all future earnings are sheltered from taxes under current tax laws. If you meet a qualifying distribution event, the Roth IRA can provide truly tax-.

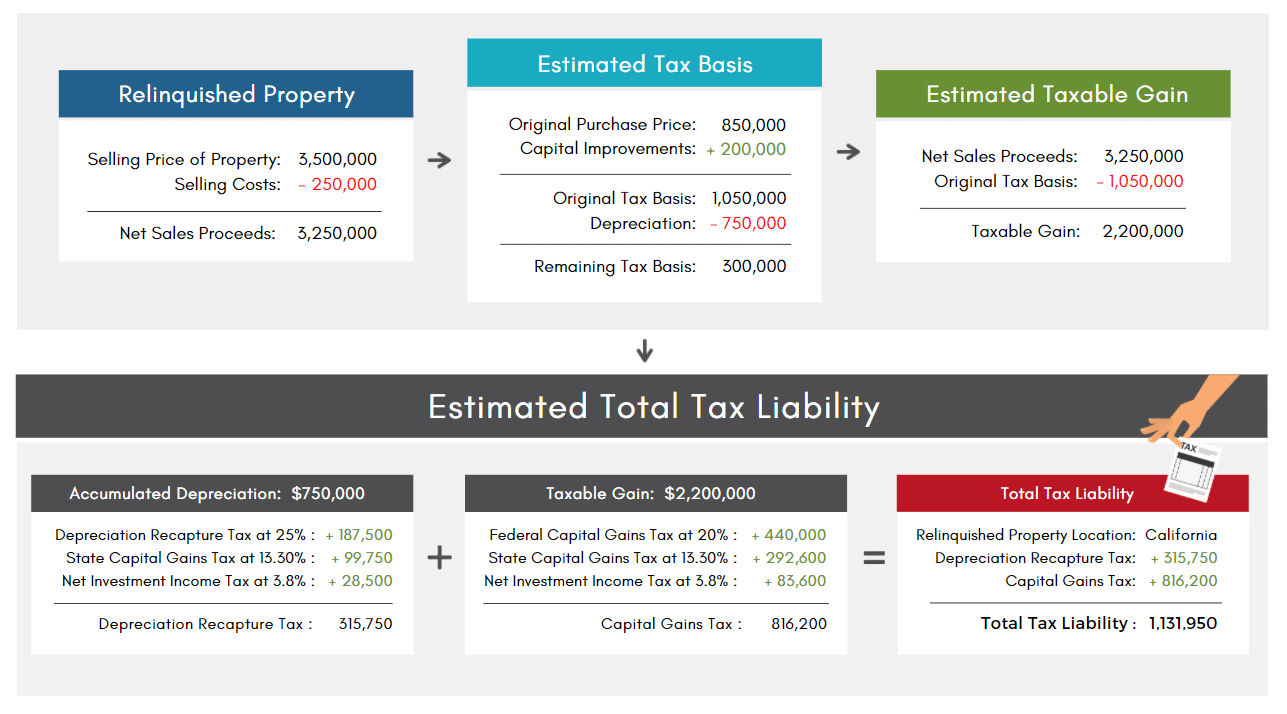

Selling Investment Property Tax

If you are selling to invest in a different property, then you can simply do a rollover and put off the tax bill.1 If you are selling because you need the. The IRS applies this requirement under the Foreign Investment in Real Property Tax Act (FIRPTA) to ensure that the seller does not avoid its tax obligations in. Use Schedule 3, Capital Gains (or Losses), to calculate and report your taxable capital gains or net capital loss. If the property you sold is a. If you turn a profit on the sale of any residential or commercial property that you own, you must be prepared to pay capital gains tax on it. Previously, the capital gains inclusion rate for secondary properties (cottages, vacation homes, investment properties) was 50%. This meant that only half of. Capital gains tax is a tax due on profit (gain) of the sale of investment property. Hopefully, when you sell your investment properties you will be making a. The tax code in the U.S. is very friendly to real estate investors. Business and operating expenses can be deducted from gross rental income. If you sell a rental property for This means any capital gains realized on the sale of this property during those years would be sheltered from tax. In this article, we'll explain how taxes on capital gains work, and how to avoid paying capital gains tax on rental property. If you are selling to invest in a different property, then you can simply do a rollover and put off the tax bill.1 If you are selling because you need the. The IRS applies this requirement under the Foreign Investment in Real Property Tax Act (FIRPTA) to ensure that the seller does not avoid its tax obligations in. Use Schedule 3, Capital Gains (or Losses), to calculate and report your taxable capital gains or net capital loss. If the property you sold is a. If you turn a profit on the sale of any residential or commercial property that you own, you must be prepared to pay capital gains tax on it. Previously, the capital gains inclusion rate for secondary properties (cottages, vacation homes, investment properties) was 50%. This meant that only half of. Capital gains tax is a tax due on profit (gain) of the sale of investment property. Hopefully, when you sell your investment properties you will be making a. The tax code in the U.S. is very friendly to real estate investors. Business and operating expenses can be deducted from gross rental income. If you sell a rental property for This means any capital gains realized on the sale of this property during those years would be sheltered from tax. In this article, we'll explain how taxes on capital gains work, and how to avoid paying capital gains tax on rental property.

tax deductions can help make an income property a worthy investment. It is Figure 1: Examples of selling rental property when CCA was not claimed. If you are thinking of selling a rental property, there is a good chance that this disposition will result in tax liability. This article will help you. Canadians are subject to the Foreign Investment in Real Property Tax Act (FIRPTA) rules. Under the FIRPTA rules, Canadian residents who sell U.S. real estate. The amount of tax depends on factors such as the property's value at the time of purchase and sale. rental property and fulfill their tax obligations. Seeking. Capital gains tax must be paid in Canada after a property is sold. 50% of what you made selling the property will be added to your annual income amount and will. You'll need to move the earned money into that property within days or you'll have to pay capital gains tax. Convert from Investment Property to Principal. Selling A Property: You owe capital gains tax when you file your taxes for that year. Changing A Property's Use: If you haven't physically sold the property but. property address · dates you purchased and sold your home · sales proceeds · tax basis of your home · amount of home sale exclusion (if any), and · total gain (or. Exchanges: exchanges allow investors to defer capital gains taxes by using proceeds from an investment property to purchase a “like kind” property. You may owe capital gains taxes if you sold stocks, real estate or other investments. Use SmartAsset's capital gains tax calculator to figure out what you. Capital gains tax only applies if you earn more from the sale than you paid originally. For example, if you purchased an investment property for $, and. However, the reality is that capital gains are simply profits from the sale of investments or property. And like any other type of income, they're subject to. The basics of a capital gain calculation is to find the difference between what you paid for your investment asset or property and what you sold it for. Let's. So when you sell a rental property, you have to pay taxes on the entire profit of the sale, called a capital gains tax and a depreciation recapture tax, whereas. A capital gain occurs when you sell an asset for more than its adjusted cost base (ACB). The ACB is simply the purchase price of the investment, plus any. If the home you're selling is not your primary residence but rather an investment property you've flipped or rented out, avoiding capital gains tax is a bit. Report the gain or loss on the sale of rental property on Form , Sales of Business Property, or on Form , Sales and Other Dispositions of Capital Assets. This applies when the business itself has capital gains on investments or property. Owners selling their businesses have the benefits described in this note. A. But if you do make money from renting or when you sell your property there will be Federal taxes (to the US government) to pay on the profit. There is also the.

Turbotax Discount Coupon Code

Recently Added Coupon Codes · SA**5: Get 25% off on all TurboTax products. · TUR***4: Save $15 on TurboTax Deluxe. · MAXR*****0: Enjoy a $ Special intuit Offers · Deal · $ off QuickBooks Pro Software and Free Shipping. · Deal · TY23 - Save up to 10% off on TurboTax. · Deal · Invoicing Software 50% off. I appreciate y'all sharing the previous codes, I got my 20% off. Here's a new one: developersjp.online Save with TurboTax coupon codes. 16 valid coupons and deals for 9/5/, PM Plus earn 7% cash back on your next TurboTax online purchase. Save $ on average with TurboTax promo codes and coupons for August Today's top TurboTax offer: 10% Off. Find 13 TurboTax coupons and discounts at. SB will not be earned for purchases using promo codes not found on Swagbucks. The use of 3rd Party Payment Services (eg. Klarna, PayPal, developersjp.online) may negate. Find 7 hand-tested TurboTax discount codes today · 10% Off TurboTax DIY · TurboTax for Students · 5% Discount on TurboTax Live Full Service · Free Federal Tax. Conquer tax season for less with TurboTax coupon codes and get peace of mind with their maximum refund guaranteed. Start your taxes now with the #1 best-selling tax software. TY23 - Save 10% on TurboTax Live Assisted. TY23 - Save 5% on TurboTax Live Full Service. Recently Added Coupon Codes · SA**5: Get 25% off on all TurboTax products. · TUR***4: Save $15 on TurboTax Deluxe. · MAXR*****0: Enjoy a $ Special intuit Offers · Deal · $ off QuickBooks Pro Software and Free Shipping. · Deal · TY23 - Save up to 10% off on TurboTax. · Deal · Invoicing Software 50% off. I appreciate y'all sharing the previous codes, I got my 20% off. Here's a new one: developersjp.online Save with TurboTax coupon codes. 16 valid coupons and deals for 9/5/, PM Plus earn 7% cash back on your next TurboTax online purchase. Save $ on average with TurboTax promo codes and coupons for August Today's top TurboTax offer: 10% Off. Find 13 TurboTax coupons and discounts at. SB will not be earned for purchases using promo codes not found on Swagbucks. The use of 3rd Party Payment Services (eg. Klarna, PayPal, developersjp.online) may negate. Find 7 hand-tested TurboTax discount codes today · 10% Off TurboTax DIY · TurboTax for Students · 5% Discount on TurboTax Live Full Service · Free Federal Tax. Conquer tax season for less with TurboTax coupon codes and get peace of mind with their maximum refund guaranteed. Start your taxes now with the #1 best-selling tax software. TY23 - Save 10% on TurboTax Live Assisted. TY23 - Save 5% on TurboTax Live Full Service.

The best TurboTax coupon today is 'TY23 - Save up to 10% off on TurboTax'. There is no code required to redeem this offer. What is the latest TurboTax coupon. 15% Off with TurboTax Coupon Code. Save 15% Off Eligible Purchases. Reveal Code. $40 Off Deal. Get $40 Off at TurboTax. Up To $40 Off Do it Yourself Plans. 8+ active TurboTax Coupons, Discount Codes & Deals for September Most popular: 5% Off Live Full Service with TurboTax Coupon: TY23*****. for the trailing 12 month period. Earnings Per Share (TTM): A company's TurboTax Paying $ Million to Taxpayers Who Could Have Filed for Free. The. September TurboTax Discount Codes | PLUS earn a up to 5% bonus | Save an average of $33 | Use one of our 7 best coupons | Offers hand tested on. September - 19 new Turbotax Canada discount codes and promo codes | Take 20% off | Save more with our verified and tested discounts and coupons. Visit developersjp.online or enter extra20online at checkout to take advantage of this discount code. Intuit, QuickBooks, QB, TurboTax, Proconnect. Get a 10% off TurboTax service code, discount coupon codes, and free Turbo Tax software deals. Save up to $20 off with TurboTax coupons Get the best price w/ turbotax top coupon codes & discount codes. ✓Updated in September Savvy shoppers, great bargains are waiting for you! [developersjp.online] 20% off Downloadable TurboTax Products until March It's once again time for the annual 20% off TurboTax promo (downloadable products). This. Save money on your online shopping with today's most popular developersjp.online discount codes & deals. ✔️✔️✔️ With WorthEPenny, saving is much easier than ever! A service code is a discount code for TurboTax. You might receive one through a marketing offer or after contacting us with an developersjp.online's where you enter. Shop these offers available at TurboTax. File for free with TurboTax Free Edition. ~37% of taxpayers qualify. Form + limited credits only. Enjoy TurboTax for free or at a reduced rate E1 – E5. Free fed and state filing with Free Edition or Deluxe. $5 off discount or bigger for Premier and Home &. Get up to 15% off on your TurboTax purchase and simplify the tax season process with this deal. Promo Code. Promo. TurboTax Canada Promo Codes, Coupon, & Deals. Intuit Coupons. WorthEPenny offers you the latest statistics of Intuit coupons. Intuit launches a series of campaigns at developersjp.online all year round, and it. Related searches. Turbotax Coupon Code · Turbo Tax Service Code Coupon · Turbotax 50% Discount Code · 35% Turbotax Discount · Turbotax Coupons Save up to 10% with these current TurboTax coupons for September The latest developersjp.online coupon codes at CouponFollow. How do I get a TurboTax discount code? TurboTax seldom offers discount codes — instead, begin a TurboTax Free tax return and keep an eye out for pop-ups.

How Do Online Brokers Work

It is possible to operate independently as a stockbroker, but most brokers work for investment banks or brokerage firms, sometimes called “brokerage companies”. Brokers purchase and sell shares and stocks via exchanges. Typically, they will charge you a commission to do this. A stockbroker is a broker who facilitates the process of buying and selling securities on a stock exchange on behalf of clients. A stock broker – also known as an investment broker – manages and executes the buying and selling of shares. Because individual investors cannot buy shares. Get unlimited commission-free online stock, ETF and options trades. Holistic view. Understanding the journey of an online trade: · A buy/ sell order is initiated by the investor on Demat & Trading Account. · Once a relevant match is found, the. Brokers purchase and sell shares and stocks via exchanges. Typically, they will charge you a commission to do this. In finance, an electronic trading platform also known as an online trading platform, is a computer software program that can be used to place orders for. This may be a traditional stock broker or an online stock brokerage. Regardless, if placing trades on a browser, mobile app, desktop platform, or over the phone. It is possible to operate independently as a stockbroker, but most brokers work for investment banks or brokerage firms, sometimes called “brokerage companies”. Brokers purchase and sell shares and stocks via exchanges. Typically, they will charge you a commission to do this. A stockbroker is a broker who facilitates the process of buying and selling securities on a stock exchange on behalf of clients. A stock broker – also known as an investment broker – manages and executes the buying and selling of shares. Because individual investors cannot buy shares. Get unlimited commission-free online stock, ETF and options trades. Holistic view. Understanding the journey of an online trade: · A buy/ sell order is initiated by the investor on Demat & Trading Account. · Once a relevant match is found, the. Brokers purchase and sell shares and stocks via exchanges. Typically, they will charge you a commission to do this. In finance, an electronic trading platform also known as an online trading platform, is a computer software program that can be used to place orders for. This may be a traditional stock broker or an online stock brokerage. Regardless, if placing trades on a browser, mobile app, desktop platform, or over the phone.

How does Wealthsimple have $0 commission on trading stocks & ETFs when other brokerages charge up to $10/trade? How do USD accounts work? Do they have FX fees. Please note that some global brokers operate via several legal entities, each regulated by a local authority – so for example, US clients would be overseen. FINRA FINANCIAL INDUSTRY REGULATORY AUTHORITY is a not-for-profit organization that oversees US broker-dealers. How does it work. When you open an account, you'll partner with a brokerage And of course, you can trade stock slices commission-free online, just as you. How do I open and online brokerage account? Opening an online brokerage account starts with choosing which broker you'd like to work with. From there, you. Think of a brokerage firm as a type of financial institution that acts as a go-between (or broker). They help investors buy and sell stocks by working with both. Work for investment companies, stock brokerage firms, stock and commodity exchanges and other establishments in the securities industry. Duties. Securities. A broker is officiated after their registration with a recognised stock exchange such as the Bombay Stock Exchange or by working for a brokerage firm. Such. A margin brokerage account works similarly to a standard account with one major difference: you can borrow money from the brokerage account to buy investments. A broker is a mediator between the buyer and the seller and who receives a payment in the form of a commission. · The main function of a broker is to solve a. Brokers help you access exchanges. In order to invest in the stock market, you'll need a broker to get your orders to the stock exchange. Make your money work harder. Take advantage of offers, programs and online brokerages. Is Questrade only online? While we operate primarily online. In finance, an electronic trading platform also known as an online trading platform, is a computer software program that can be used to place orders for. Brokers purchase and sell shares and stocks via exchanges. Typically, they will charge you a commission to do this. A valued brokerage is licensed to trade in. How do brokerages make money if not through commissions? · Payment for order flow (PFOF). Commission-free brokers typically receive payment (in the form of. Brokers help you access exchanges. In order to invest in the stock market, you'll need a broker to get your orders to the stock exchange. How Stock Markets Work · Public Companies · Market Participants · Types of Orders broker and ask him or her to do this. But some brokers may charge for. Service charges apply for trades placed through a broker ($25). Stock plan account transactions are subject to a separate commission schedule. All fees and. Leading online trading solutions for traders, investors and advisors, with direct global access to stocks, options, futures, currencies, bonds and funds.

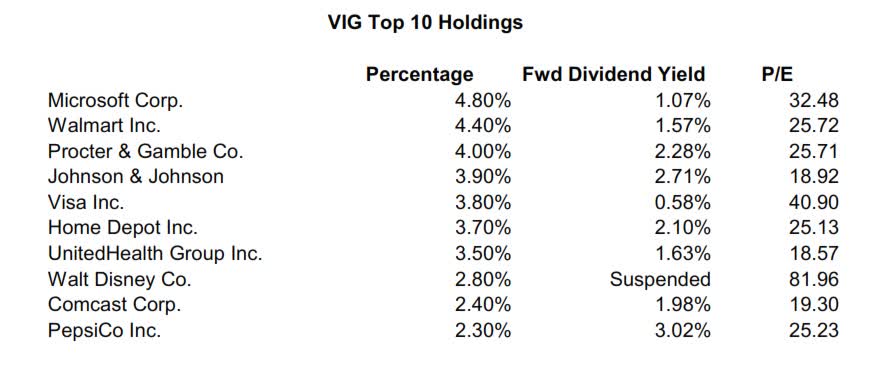

Vig Top Holdings

Holdings details. as of 07/31/ Export full holdings. Equity The top 10% of products in each product category receive 5 stars. Analysis of the Vanguard Dividend Appreciation ETF ETF (VIG). Holdings, Costs, Performance, Fundamentals, Valuations and Rating Top 10 Holdings Complete list. VIG Holdings List ; 3, MSFT, Microsoft Corporation ; 4, JPM, JPMorgan Chase & Co. ; 5, XOM, Exxon Mobil Corporation ; 6, UNH, UnitedHealth Group Incorporated. Holdings Details. Avg P/E Ratio. Avg Price/Book Ratio. ? Short Top 10 Holdings VIG. As of 6/30/ Name, % of Total Portfolio. Apple Inc. Top 10 holdings ; Visa Inc V:NYQ, +%, % ; Procter & Gamble Co PG:NYQ, +%, %. Top 10 Holdings. Company, Symbol, Total Net Assets. Apple Inc. AAPL, %. Broadcom Inc. AVGO, %. Microsoft Corp. MSFT, %. JPMorgan Chase & Co. JPM. Holdings: VIG. View More. Top 10 Holdings (% of Total Assets). SymbolCompany% Assets. AAPL. Apple Inc. %. AVGO. Broadcom Inc. %. MSFT. Microsoft. Find Vanguard Dividend Appreciation Index Fund ETF Shares (VIG) top 10 holdings and sector breakdown by %. VIG Portfolio - Learn more about the Vanguard Dividend Appreciation ETF investment portfolio including asset allocation, stock style, stock holdings and more. Holdings details. as of 07/31/ Export full holdings. Equity The top 10% of products in each product category receive 5 stars. Analysis of the Vanguard Dividend Appreciation ETF ETF (VIG). Holdings, Costs, Performance, Fundamentals, Valuations and Rating Top 10 Holdings Complete list. VIG Holdings List ; 3, MSFT, Microsoft Corporation ; 4, JPM, JPMorgan Chase & Co. ; 5, XOM, Exxon Mobil Corporation ; 6, UNH, UnitedHealth Group Incorporated. Holdings Details. Avg P/E Ratio. Avg Price/Book Ratio. ? Short Top 10 Holdings VIG. As of 6/30/ Name, % of Total Portfolio. Apple Inc. Top 10 holdings ; Visa Inc V:NYQ, +%, % ; Procter & Gamble Co PG:NYQ, +%, %. Top 10 Holdings. Company, Symbol, Total Net Assets. Apple Inc. AAPL, %. Broadcom Inc. AVGO, %. Microsoft Corp. MSFT, %. JPMorgan Chase & Co. JPM. Holdings: VIG. View More. Top 10 Holdings (% of Total Assets). SymbolCompany% Assets. AAPL. Apple Inc. %. AVGO. Broadcom Inc. %. MSFT. Microsoft. Find Vanguard Dividend Appreciation Index Fund ETF Shares (VIG) top 10 holdings and sector breakdown by %. VIG Portfolio - Learn more about the Vanguard Dividend Appreciation ETF investment portfolio including asset allocation, stock style, stock holdings and more.

Largest Holdings ; JPM-img JPMorgan Chase & Co. JPM. % ; XOM-img Exxon Mobil Corp. XOM. 3% ; UNH-img UnitedHealth Group Incorporated. UNH. % ; V-img Visa Inc. For example, the top sectors for VIG are technology and financial services with top holdings like Microsoft Corp (MSFT) and JPMorgan Chase and Co. (JPM). Recent NAV Premium: % ; NAV Symbol: developersjp.online ; Number of Holdings: ; Annualized Yield: % ; Annualized Distribution: Top 10 Holdings · MICROSOFT CORP % · APPLE INC % · BROADCOM INC % · JPMORGAN CHASE % · EXXON MOBIL CORP % · UNITEDHEALTH GRP % · VISA INC-CLASS. Holdings are market-cap-weighted, with individual security weights capped at 4%. The index reconstitutes annually. Overall, VIGs strategy provides a sustainable. Top 10 VIG Holdings · Apple(NASDAQ:AAPL) Holding Weight: % · Microsoft(NASDAQ:MSFT) Holding Weight: % · Broadcom(NASDAQ:AVGO) Holding Weight: %. VIG Portfolio ; Microsoft Corp, % ; Johnson & Johnson, % ; Coca-Cola Co, % ; Procter & Gamble Co, %. Volume: K ; Dividend Yield %. ; Last Holding update , Stocks (45 new) ; Value $ Bil, Turnover 9 % ; Top Holdings · MSFT(%) AAPL. VIG Logo, Vanguard Dividend Appreciation Index Fund ETF (VIG) Holdings ; Mondelez International Inc · MDLZ, Consumer Defensive - Confectioners, % ; VIG Top Holdings ; AAPL · Apple Inc, % ; MSFT · Microsoft Corp, % ; AVGO · Broadcom Inc, % ; JPM · JPMorgan Chase & Co, %. Find Vanguard Dividend Appreciation Index Fund ETF Shares (VIG) top 10 holdings and sector breakdown by % Top 10 Holdings. Apple Inc. %. Broadcom Inc. VIG Portfolio - Learn more about the Vanguard Dividend Appreciation ETF investment portfolio including asset allocation, stock style, stock holdings and. VIG: Vanguard Dividend Appreciation ETF - Fund Holdings. Get up to date fund holdings for Vanguard Dividend Appreciation ETF from Zacks Investment Research. Top 10 Holdings ; Broadcom Inc AVGO, - ; Exxon Mobil Corp. XOM, - ; Unitedhealth Group Inc UNH, - ; Visa Inc - Ordinary Shares - Class A V, -. Top 10 Holdings ; XOM, Exxon Mobil Corp. % ; Portfolio Details data as of 07/31/% of portfolio in top 10 holdings: %. Top YTD Performer, MTUM, %, $ B, ,, %. Top 15 Holdings New. Vanguard Dividend Appreciation ETF. Symbol Symbol, Holding Holding, % Assets %. List of VIG holdings (top 50 holdings) and the weight of each asset. Also a VIG holdings chart to visualize asset weight percentages. The top 10 holdings constitute % of the ETF's assets. The ETF meets the VIG Performance and Fees. High portfolio turnover can translate to. Top 10 Holdings Broadcom Inc. JPMorgan Chase & Co. Exxon Mobil Corp. Unitedhealth Group Inc. Visa Inc. %. Top 10 Holdings ; Microsoft Corporation, MSFT, % ; JPMorgan Chase & Co. JPM, % ; Exxon Mobil Corporation, XOM, % ; UnitedHealth Group Incorporated, UNH.

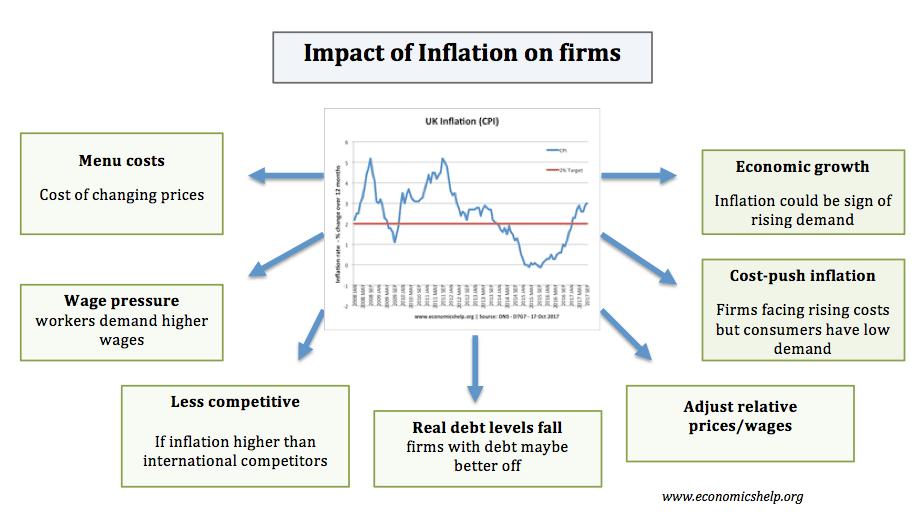

Why Do Interest Rate Rise When Inflation Goes Up

This occurs because lenders will demand higher interest rates as compensation for the decrease in purchasing power of the money they are paid in the future. How do higher interest rates lower inflation? When the Fed raises interest rates, it increases the cost of borrowing money. As a result, the demand for products. Raising the interest rates limits peoples ability to borrow money, thus limiting their supply of money limiting their ability to spend money. This increases your money's purchasing power. 2. Interest rates on different consumer products may fluctuate. When rates increase, banks and credit unions raise. Taylor) recommends that interest rates rise one-and-a-half times as much as inflation. So if inflation rises from 2 percent to 5 percent, interest rates should. They are important because expectations about future price increases can affect current economic decisions that can influence actual inflation outcomes. For. My research suggests that in the short run, raising interest rates could actually make inflation worse, as business cost increases from rate hikes get passed. However, as we've seen above, when inflation rises above the target rate set out for an economy, a central bank might respond by raising interest rates. If. A higher rate helps decrease inflation and a lower one helps it rise. Learn interest rate increases demand in the economy and causes inflation to rise. This occurs because lenders will demand higher interest rates as compensation for the decrease in purchasing power of the money they are paid in the future. How do higher interest rates lower inflation? When the Fed raises interest rates, it increases the cost of borrowing money. As a result, the demand for products. Raising the interest rates limits peoples ability to borrow money, thus limiting their supply of money limiting their ability to spend money. This increases your money's purchasing power. 2. Interest rates on different consumer products may fluctuate. When rates increase, banks and credit unions raise. Taylor) recommends that interest rates rise one-and-a-half times as much as inflation. So if inflation rises from 2 percent to 5 percent, interest rates should. They are important because expectations about future price increases can affect current economic decisions that can influence actual inflation outcomes. For. My research suggests that in the short run, raising interest rates could actually make inflation worse, as business cost increases from rate hikes get passed. However, as we've seen above, when inflation rises above the target rate set out for an economy, a central bank might respond by raising interest rates. If. A higher rate helps decrease inflation and a lower one helps it rise. Learn interest rate increases demand in the economy and causes inflation to rise.

When the inflation rate goes up, it indicates that the prices of many goods and services are going up—your dollars will then buy less than they did before. In. Higher productivity growth is generally associated with new investment opportunities that increase the demand for capital, driving up interest rates. In recent. This increases your money's purchasing power. 2. Interest rates on different consumer products may fluctuate. When rates increase, banks and credit unions raise. If interest rate rises, meaning the cost of borrowing goes up, consumers will be more inclined to save than spend. rate hikes), investors will enjoy higher. If the (nominal) interest rate of the savings is higher than inflation, the real interest rate is positive and the purchasing power of your savings increases. Interest rate, The rate is fixed at auction and The principal (called par value or face value) of a TIPS goes up with inflation and down with deflation. How do higher interest rates lower inflation? When the Fed raises interest rates, it increases the cost of borrowing money. As a result, the demand for products. This increases demand for certain goods and services, which could lead to a rise in inflation. Why do interest rates matter? Interest rates can affect. When investors worry that a bond's yield won't keep up with the rising costs of inflation, the price of the bond drops because there is less investor demand for. The federal government responded with sharp increases in fiscal spending, and the Federal Reserve lowered interest rates to near zero and kept them there for. Long-lasting episodes of high inflation are often the result of lax monetary policy. If the money supply grows too big relative to the size of an economy, the. They need to attract customers. When prices don't go up so quickly, inflation falls. Interest rates affect spending in a number of ways. Higher interest rates. When the inflation rate is high, interest rates tend to rise too – so although it costs you more to borrow and spend, you could also earn more on the money you. Lower interest rates work in the opposite way and can help increase inflation if it is too low. Of course, the Bank doesn't respond to every movement in. Increasing the bank rate is like a lever for slowing down inflation. By raising it, people should, in theory, start to save more and borrow less. Such demand could result from things like a low jobless rate, strong consumer confidence or low interest rates. Companies, however, can't always keep up with. Lowering rates stimulates the economy; raising rates slows the economy down. The agency doesn't actually set the funds rate — banks do that — but "the Fed. Lowering rates stimulates the economy; raising rates slows the economy down. The agency doesn't actually set the funds rate — banks do that — but "the Fed. When the inflation rate goes up, it indicates that the prices of many goods and services are going up—your dollars will then buy less than they did before. In. The interest rate on a Series I savings bond changes every 6 months, based on inflation. The rate can go up. The rate can go down.

Billionaires That Give Away Free Money

For the first 15 years of his philanthropic mission, Mr Feeney donated money in secret leading to him being dubbed the James Bond of philanthropy, only emerging. 1. Chuck Feeney. Lifetime Giving: $ billion (all of current net worth) · The Atlantic Philanthropies ; 2. Karen and Jon Huntsman. Lifetime Giving: $ The Giving Pledge is a promise by the world's wealthiest individuals and families to dedicate the majority of their wealth to charitable causes. Other billionaires with some of the largest net worths include LVMH's Arnault, Microsoft's Bill Gates, and Oracle's Larry Ellison. Eight of the top I advise you to visit YouTube and download the video titled “Websites where rich people are giving away money for free”. You will be able to see. He also gave truckloads of FREE O.J. to Christian colleges throughout the country! 25 years before he died, he give away all his money to strangers. This is. GoGetFunding: This platform allows you to raise funds for a wide range of causes, including personal ones. Once you create your page and list. During his lifetime, Carnegie gave away over $ million. Many persons of wealth have contributed to charity, but Carnegie was perhaps the first to state. Meet some of the millionaires who support a wealth tax · Abigail Disney · Peter Windischhofer · Karl Munthe-Kaas · Sylvie Trottier · Maarten Meijnen · Stefanie Bremer. For the first 15 years of his philanthropic mission, Mr Feeney donated money in secret leading to him being dubbed the James Bond of philanthropy, only emerging. 1. Chuck Feeney. Lifetime Giving: $ billion (all of current net worth) · The Atlantic Philanthropies ; 2. Karen and Jon Huntsman. Lifetime Giving: $ The Giving Pledge is a promise by the world's wealthiest individuals and families to dedicate the majority of their wealth to charitable causes. Other billionaires with some of the largest net worths include LVMH's Arnault, Microsoft's Bill Gates, and Oracle's Larry Ellison. Eight of the top I advise you to visit YouTube and download the video titled “Websites where rich people are giving away money for free”. You will be able to see. He also gave truckloads of FREE O.J. to Christian colleges throughout the country! 25 years before he died, he give away all his money to strangers. This is. GoGetFunding: This platform allows you to raise funds for a wide range of causes, including personal ones. Once you create your page and list. During his lifetime, Carnegie gave away over $ million. Many persons of wealth have contributed to charity, but Carnegie was perhaps the first to state. Meet some of the millionaires who support a wealth tax · Abigail Disney · Peter Windischhofer · Karl Munthe-Kaas · Sylvie Trottier · Maarten Meijnen · Stefanie Bremer.

Donors can claim substantial charitable tax benefits for these contributions in the year they donate, but the money often fails to move out of the DAFs in a. In fact, the business investor has pledged to give away 99% of his wealth over his lifetime. He created The Giving Pledge to convince more of the world's top. 10 Billionaires That Are Giving Away Their Fortune · Mark Zuckerberg · Bill Gates · Paul Allen · Richard Branson · Warren Buffett · Elon Musk · Sara Blakely · Ted. The Giving Pledge is a promise by the world's wealthiest individuals and families to dedicate the majority of their wealth to charitable causes. I advise you to visit YouTube and download the video titled “Websites where rich people are giving away money for free”. You will be able to see. GoGetFunding: This platform allows you to raise funds for a wide range of causes, including personal ones. Once you create your page and list. The best-known example, of course, is MacKenzie Scott's fast-paced push to give away billions, following her divorce from Amazon founder Jeff. 1. Bill and Melinda Gates this year, challenging the wealthiest Americans to give at least half of their money to charity before or when they die. So far, The term may apply to any volunteer or to anyone who makes a donation, but the label is most often applied to those who donate large sums of money or who make a. OpenSecrets is the nation's premier research and government transparency group tracking money in politics and its effect on elections and policy. The Giving Pledge is a simple concept: an open invitation for billionaires, or those who would be if not for their giving, to publicly commit to give the. OpenSecrets is the nation's premier research and government transparency group tracking money in politics and its effect on elections and policy. GiveDirectly allows donors to send money directly to people in poverty with no strings attached. Our approach is guided by rigorous evidence of impact and. Best argument I've seen for this so far is the “that's like me only donating $5 of my money” THEN DONATE $5!!! $5 is better than $0!!!! 1. Bill and Melinda Gates this year, challenging the wealthiest Americans to give at least half of their money to charity before or when they die. So far, Charles Francis Feeney (April 23, – October 9, ) was an American businessman and philanthropist who made his fortune as a co-founder of Duty Free. money on their clothes. Do yourself a favor and don't fall for the free stuff they offer you because it's a headache, scam and free advertisement for them. Billionaires Giving Away Free Money - Frequently Asked Questions. Millionaires Giving Money. Read it. Save. Read it. Save. More like this. Mother Teresa. You don't have to be a billionaire or give money away to be considered a philanthropist. Giving some of your free time to causes you. give their money away”. He added,”The incentives are set up in such a way that donors are rewarded for giving money. And, to some extent, I think, coddled.

Gst Bill Software

Discover the ultimate GST billing software designed to simplify your billing process and ensure compliance with Indian tax regulations. CaptainBiz is a complete business accounting, inventory management and online billing software for small businesses in India. You can send invoices over. A Complete GST Billing & Business Management Software. Designed & developed for the amazing small & medium businesses of India! Go GST Bill is available on Android and iOS so you can access your billing data and manage invoices on the go. myBillBook is free billing software for Mac PCs, designed for retailers and wholesalers to generate GST bills and simplify the entire accounting process. “. No.1 Free billing software in India which fully supports GST, SMS, Barcode, Inventory and Customers. 1 million satisfied users. Kernel's GST billing software allows you to simplify and automate GST billing, invoicing, e-way bills & expenses on any device. Sales, expenses, clients and. ClearOne is the best billing software that provides multiple features and billing template. Create, Share & track bills at ease at anytime & anywhere. Download Gofrugal's GST Billing software free and enjoy flexibility with a high range of features. Start your day trial with our free GST billing software. Discover the ultimate GST billing software designed to simplify your billing process and ensure compliance with Indian tax regulations. CaptainBiz is a complete business accounting, inventory management and online billing software for small businesses in India. You can send invoices over. A Complete GST Billing & Business Management Software. Designed & developed for the amazing small & medium businesses of India! Go GST Bill is available on Android and iOS so you can access your billing data and manage invoices on the go. myBillBook is free billing software for Mac PCs, designed for retailers and wholesalers to generate GST bills and simplify the entire accounting process. “. No.1 Free billing software in India which fully supports GST, SMS, Barcode, Inventory and Customers. 1 million satisfied users. Kernel's GST billing software allows you to simplify and automate GST billing, invoicing, e-way bills & expenses on any device. Sales, expenses, clients and. ClearOne is the best billing software that provides multiple features and billing template. Create, Share & track bills at ease at anytime & anywhere. Download Gofrugal's GST Billing software free and enjoy flexibility with a high range of features. Start your day trial with our free GST billing software.

GST billing software is a digital tool designed to automate and streamline the process of generating invoices and managing billing operations while ensuring. To download the accounting and billing software on the GST Portal, login to the GST Portal with valid credentials. Navigate to Downloads > Accounting and. Go GST Bill is cloud-based, simple, and powerful GST billing software that helps you simplify your daily billing needs. Features Of Our GST Accounting Software · GST Billing & Invoicing. With Munim's GST invoice software, you can generate GST-compliant invoices in a blink of an. Stay compliant with GimBooks GST billing software. Try our online invoice generator and GST invoice manager to create pro invoices. Sign up for free trial! Online GST Billing Software Easy to Use 2 Min Setup Specially created for Indian Businesses Create Beautiful Invoices Create GST Returns in one click Get. TallyPrime: Complete GST Software for Indian Businesses. GST invoicing | Connected e-invoice & e-way bill solution | Auto-filled GST returns | GST. Small business owners can now generate easy and accurate GST-compliant bills with Moon Invoice. Get 66+ GST bill templates that are fully customizable. ClearOne is India's No.1 GST billing, invoicing, payment collection & inventory management software for small & medium businesses. Create Quotations, E-way. Marg ERP is a technology-driven company delivering Billing, Payment & Delivery Solutions for Small & Medium Businesses since Free billing software with GST and all invoice features, designed for the modern businesses in India. It's time to upgrade to the best gst billing solution! Online Billing Software for your growing businesses. Create GST Bills, Manage Stock, File GST Returns and never miss a payment with ClearTax GST Billing. Gst Invoice Maker, also known as gst billing software for mobile, is an easy and fast Gst Invoice Maker App for sending your business customers invoice. Munim is India's most versatile accounting and billing software. With plenty of features, it's simple and easy. Try now, it's free! Key Features of GST Invoicing Software Effortlessly create and customize professional invoices instantly. Stay on top of receipts and dues, and speed up. Vyapar is the free invoicing software. It comes with various useful billing and accounting features. Using the app makes business management hassle-free for. CaptainBiz Features. Our GST billing software feature is designed to simplify business operations. It efficiently generates accurate GST reports for compliance. Refrens GST billing software stands as the digital cornerstone of seamless and efficient GST-related transactions. Designed to cater for businesses of all sizes. Refrens e-Invoicing software under GST is easy and faster. Generate IRN for e-invoice. Over + businesses use Refrens e-invoice. Simple, efficient and free GST billing software. Specially designed for Indian small businesses. Does all the Hard Work. Sleek Bill does all the work for you.

Why Do A Press Release

There are several different approaches to writing a press release. However, certain elements are common to most releases. Those elements include the press. What We Do · Accreditation and Excellence · Advocacy · Advisors & Speakers Bureau Press Releases. AAM Announces Latest Accreditation Awards: 35 Museums. A press release is an official statement delivered to members of the news media for the purpose of providing information, creating an official statement. Agency News Releases · Agency Reports · Blog · Digital · Press Releases · Press Release Archives · Radio. Press Releases. Show Press Releases to. Aug 16, We don't just distribute press releases. We deliver fully branded, accessible, and actionable news content to the audiences who are most interested. · Better. pr length and formatting. Keep your press release to two pages at absolute maximum – if possible get the body of the release on one page and include notes to. A news release should give members of the media everything they need to write a story that will grab their readers' attention. To help your release get the. Press releases allow law firms to share their successes, announce new hires or promotions, and position themselves as thought leaders in their respective. A press release is basically a document about newsworthy things that is sent out to the media for them to publish / write stories on. For. There are several different approaches to writing a press release. However, certain elements are common to most releases. Those elements include the press. What We Do · Accreditation and Excellence · Advocacy · Advisors & Speakers Bureau Press Releases. AAM Announces Latest Accreditation Awards: 35 Museums. A press release is an official statement delivered to members of the news media for the purpose of providing information, creating an official statement. Agency News Releases · Agency Reports · Blog · Digital · Press Releases · Press Release Archives · Radio. Press Releases. Show Press Releases to. Aug 16, We don't just distribute press releases. We deliver fully branded, accessible, and actionable news content to the audiences who are most interested. · Better. pr length and formatting. Keep your press release to two pages at absolute maximum – if possible get the body of the release on one page and include notes to. A news release should give members of the media everything they need to write a story that will grab their readers' attention. To help your release get the. Press releases allow law firms to share their successes, announce new hires or promotions, and position themselves as thought leaders in their respective. A press release is basically a document about newsworthy things that is sent out to the media for them to publish / write stories on. For.

Press conferences are held by companies or individuals and are attended by the media. During the event, one or more speakers may address those attending. The ideal length of a press release is between and words and should be no longer than a page with spacing and formatting taken into consideration. With. What We Do. Open Item. What We Do · Amazon Store · Delivery and Logistics · Devices Press release archive. 3, results 3, results. Refine. Submit. Open. Another way to share photos with a press release is to upload the photos to a website or cloud storage service and include a link to the photos in the press. Why write a press release? · Attract media attention · Garner publicity and brand awareness · Improve SEO · Shape public perception of your business. Press Releases · August · July · June · May · April · March · February · January Press Releases. The Office of the Spokesperson releases statements, media notes, notices to the press and fact sheets on a daily basis. Tips for Press Release Headlines. Write your headline in Title Case, not ALL CAPS. ALL CAPS IS HARD TO READ, AND JUST COMES ACROSS AS OBNOXIOUS. Stick to title. Before sharing sensitive or personal information, make sure you're on an official state website. Press Releases. Gov. Kemp Hosts Small Business. PR Newswire's news distribution, targeting, monitoring and marketing solutions help you connect and engage with target audiences across the globe. Follow these 6 steps to master the art of the press release and get your small business noticed. · 1. Re-read the release to ensure it promotes the story, not. Top tips for sending your press release · 1. Don't bulk email · 2. Personalize your pitch · 3. Watch your tone · 4. Use your subject line to summarize the story. DO: Add links to research, facts, statistics or trends that could be helpful to the journalist writing the story. Take it from a PR News editor/reporter: Fresh. Send Your Press Release Early, Under Embargo: Doing this will provide your target media outlets with enough of a lead to cover your story in a timely fashion. I think the most important thing to remember about press releases is they have to be short. An ideal press release is about words. That's just three or. What is the format of a press release? Press releases begin with contact information on the top left and “FOR IMMEDIATE RELEASE” at the top right. Below is. Set the embargo as either 'None' to allow journalists to publish your story immediately or 'Embargo Until' to specify the date and time you would like to. Press Release. 23 August SC/ Security Council ISIL (Da'esh) and Al 'We Must All Do More to Protect, Safeguard Our Common Humanity', Says. The term “immediate release” means the information is ready to publish and can be used by journalists as soon as they receive it. Occasionally, you might want. A press release is a subtle piece of advertorial: a combination of advertising and editorial content. The point of advertising is to bring a product, service.